Alarming: Forex reserves drop to lowest level since Jan 2019

Foreign xchange reserves held by SBP clock in at $6,700 million as of December 9

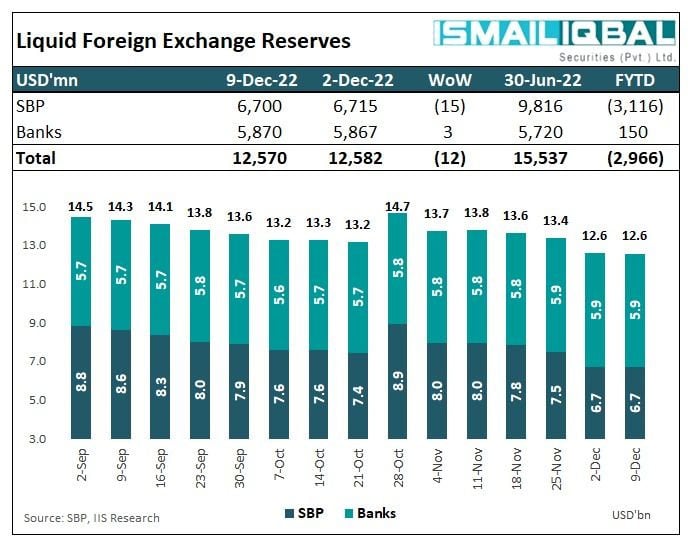

Foreign exchange reserves held by the State Bank of Pakistan (SBP) fell to $6.7 billion, official data released on Thursday showed, as the cash-strapped nation struggles to meet

The forex reserves held by the central bank were recorded at $6,700 million as of December 9, down $15 million compared with $6,714.9 on December 2, the statement issued in this regard read.

Amid the country battling decades of high inflation and scrambling to secure International Monetary Fund (IMF) funds the decline means the reserves have fallen further from last week's barely one month of import cover.

Overall liquid foreign currency reserves held by the country — including net reserves held by banks other than the SBP — stood at $12,570.2 million.

Net reserves held by banks amounted to $5,870.2 million. The central bank cited no reason for this as “reserves did not record any major change during the week.”

Pakistan is in dire need of funds to cover its current account deficit and debt obligations, for which it needs more than $30 billion in external financing this financial year.

Expected funds from the IMF have been delayed as officials struggle to convince the Fund to hold the ninth review as it is yet to formally begin.

It should be noted that last week country’s foreign exchange reserves have fallen below the $7 billion level for the first time since January 2019. The current reserves stand at around $6.7 billion — almost equal to $6.6 billion on January 18, 2019.

The $6.7 billion reserves are not enough to service the $8.8 billion principal and interest payments during the January-March period of the current fiscal year.

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations

-

Netflix revises Warner Bros. deal to $83 billion: All-cash offer