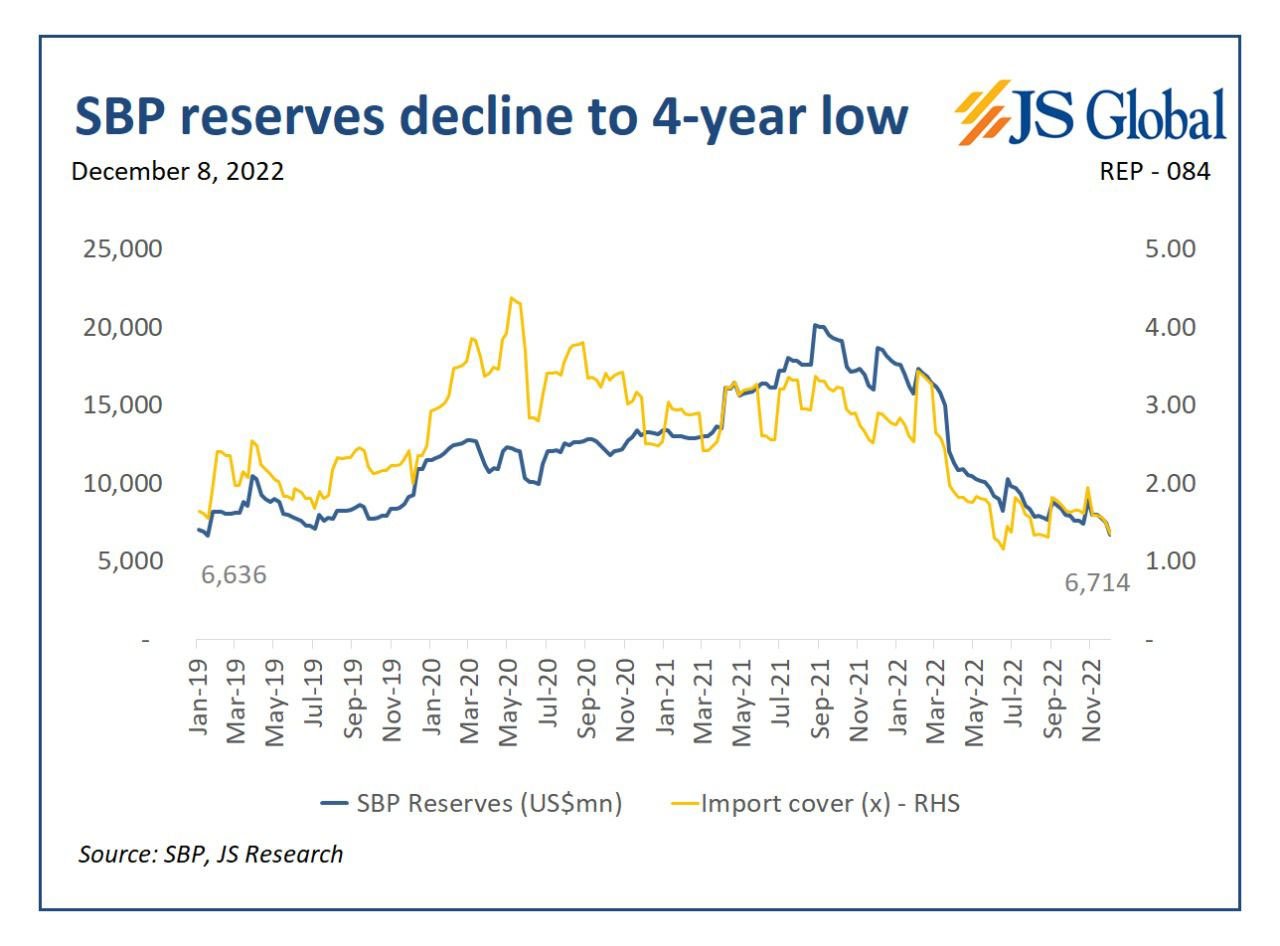

Forex reserves plummet below $7bn to four-year low

Foreign exchange reserves have fallen below the $7 billion level for the first time since January 2019

The State Bank of Pakistan-held foreign exchange reserves plummeted to a critical level after falling 10.45% to $6.7 billion to a four-year low.

Data released by the central bank showed that the foreign currency reserves held by the SBP were recorded at $6,714.9 million as of December 2, down $784 million compared with $7,825.7 on November 25.

The foreign exchange reserves have fallen below the $7 billion level for the first time since January 2019.

The current reserves stand at around $6.7 billion — almost equal to $6.6 billion on January 18, 2019.

The central bank attributed the decline to the payment of $1,000 million against maturing Pakistan International Sukuk and some other external debt repayments.

The SBP mentioned that some of the debt repayments were offset by inflows, mainly $500 million received from Asian Infrastructure Investment Bank (AIIB).

Overall liquid foreign currency reserves held by the country — including net reserves held by banks other than the SBP — stood at $12,581.7 million. Net reserves held by banks amounted to $5,866.8 million.

With the current foreign exchange reserves position, Pakistan has an import cover of less than one month.

The $6.7 billion reserves are not enough to service the $8.8 billion principal and interest payments during the January-March period of the current fiscal year.

Commenting on the severity of the dollar crunch, the Ministry of Finance’s former adviser Dr Khaqan Hassan Najeeb, said that it is important to consider that Pakistan has only received $4 billion dollars in the last five months (July-November 2022) — this is beside the Saudi Arabia rollover.

“The slow inflow of funds, heavy payments — including Sukuk payment — and a less than satisfactory financial account have all added pressure on the reserves which now barely cover a month and 10 days of import payment,” he stated.

The economist added that depleting foreign reserves hurt the confidence of both domestic and foreign investors, keeps markets jittery and add pressure on the foreign exchange markets.

“Pakistan needs to immediately ensure that the ninth review of the International Monetary Fund (IMF) is completed and fund flows from bilateral and multilateral donors for projects are received immediately to shore up our reserves,” he suggested.

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold