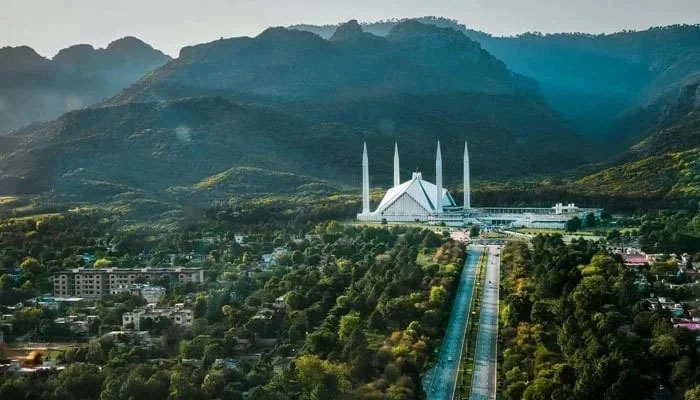

CDA hikes property tax, expands it to entire ICT

Earlier, CDA used to receive property tax from owners of commercial and residential buildings in sectors only

ISLAMABAD: The Capital Development Authority (CDA), while increasing rates of property tax, expanded it to the whole Islamabad Capital Territory (ICT) in order to increase revenue collection.

Previously, the CDA used to receive property tax from owners of commercial and residential buildings in sectors only. However, for the first time, a flat rate of property tax has been introduced.

The employees of private organisations registered with the EOBI, like the government employees, would also get 10 per cent concession on the tax, while same concession would also be given on payment dues by September 30 every year.

All government hospital, educational institutions and libraries and offices of federal and provincial governments would be exempted from tax. However, buildings of semi-government institutions would not get any exemption.

In Sector E-11, model towns and PHA Kurri Housing scheme, the CDA would imposed Rs24,000 per year tax on houses constructed on 140 yards plots, while the tax would increase to Rs200,000 on houses constructed on plot measuring 4,000 yards.

Similarly, the CDA would receive Rs25,000 tax on house measuring 140 yards, which would increase to Rs227,000 per year on houses constructed on plot size of 2000 yards in Park Enclave.

The civic body has also imposed property tax on houses located in Defence Housing Authority (DHA), Bahria Enclave and Bahria Town where tax on five-marla house would be Rs27,000 per year and Rs298,000 on six-kanal houses.

The minimum tax for houses in Gulberg and Naval Anchorage would be Rs20,000 and maximum Rs170,000. For D series, tax would range from Rs27,000 to Rs246,000, for G series, minimum property tax is Rs28,000 and maximum Rs249,000, for F series, property tax would range from Rs35,000 to Rs1.2 million, and for I series, minimum tax is Rs25,000 and maximum Rs271,000.

-

James Van Der Beek's Friends Helped Fund Ranch Purchase Before His Death At 48

James Van Der Beek's Friends Helped Fund Ranch Purchase Before His Death At 48 -

King Charles ‘very Much’ Wants Andrew To Testify At US Congress

King Charles ‘very Much’ Wants Andrew To Testify At US Congress -

Rosie O’Donnell Secretly Returned To US To Test Safety

Rosie O’Donnell Secretly Returned To US To Test Safety -

Meghan Markle, Prince Harry Spotted On Date Night On Valentine’s Day

Meghan Markle, Prince Harry Spotted On Date Night On Valentine’s Day -

King Charles Butler Spills Valentine’s Day Dinner Blunders

King Charles Butler Spills Valentine’s Day Dinner Blunders -

Brooklyn Beckham Hits Back At Gordon Ramsay With Subtle Move Over Remark On His Personal Life

Brooklyn Beckham Hits Back At Gordon Ramsay With Subtle Move Over Remark On His Personal Life -

Meghan Markle Showcases Princess Lilibet Face On Valentine’s Day

Meghan Markle Showcases Princess Lilibet Face On Valentine’s Day -

Harry Styles Opens Up About Isolation After One Direction Split

Harry Styles Opens Up About Isolation After One Direction Split -

Shamed Andrew Was ‘face To Face’ With Epstein Files, Mocked For Lying

Shamed Andrew Was ‘face To Face’ With Epstein Files, Mocked For Lying -

Kanye West Projected To Explode Music Charts With 'Bully' After He Apologized Over Antisemitism

Kanye West Projected To Explode Music Charts With 'Bully' After He Apologized Over Antisemitism -

Leighton Meester Reflects On How Valentine’s Day Feels Like Now

Leighton Meester Reflects On How Valentine’s Day Feels Like Now -

Sarah Ferguson ‘won’t Let Go Without A Fight’ After Royal Exile

Sarah Ferguson ‘won’t Let Go Without A Fight’ After Royal Exile -

Adam Sandler Makes Brutal Confession: 'I Do Not Love Comedy First'

Adam Sandler Makes Brutal Confession: 'I Do Not Love Comedy First' -

'Harry Potter' Star Rupert Grint Shares Where He Stands Politically

'Harry Potter' Star Rupert Grint Shares Where He Stands Politically -

Drama Outside Nancy Guthrie's Home Unfolds Described As 'circus'

Drama Outside Nancy Guthrie's Home Unfolds Described As 'circus' -

Marco Rubio Sends Message Of Unity To Europe

Marco Rubio Sends Message Of Unity To Europe