SBP slashes interest rate to 11%, beating market expectations

MPC says decision driven by sharp drop in inflation in March and April

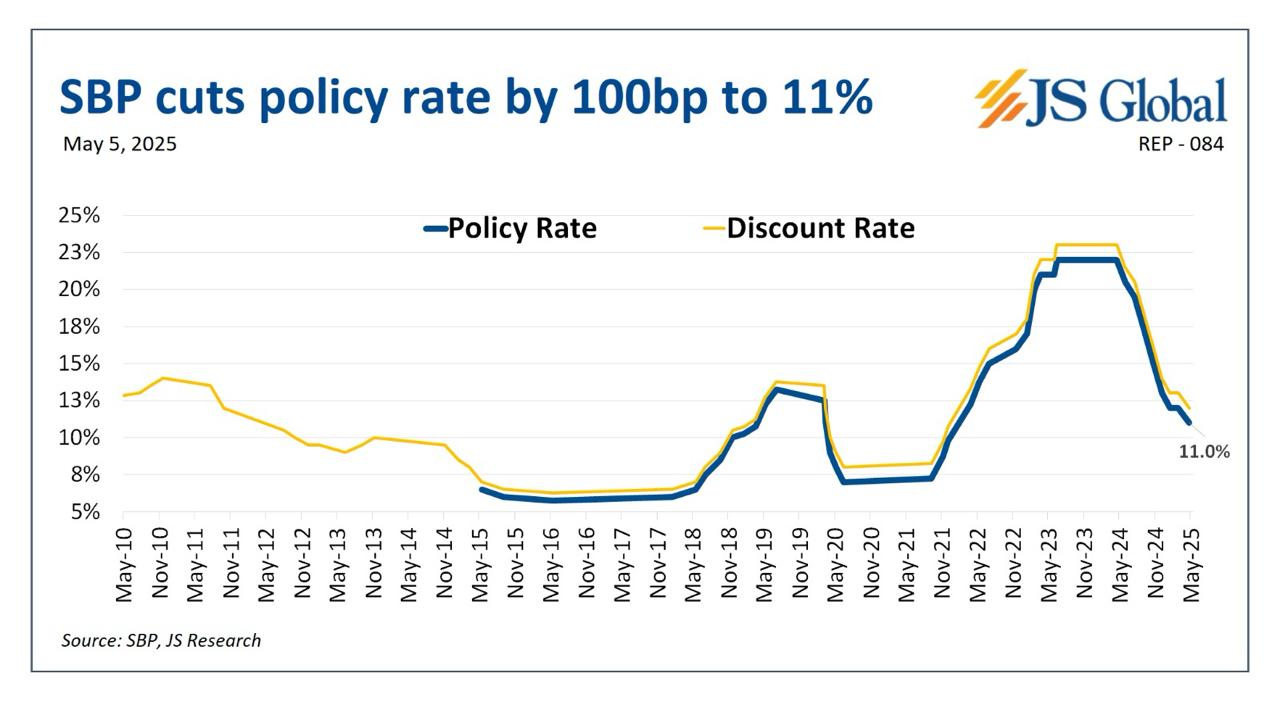

KARACHI: Extending its dovish streak, the State Bank of Pakistan (SBP) cut its key interest rate by 100 basis points to 11% on Monday, citing a sharp decline in core inflation over the past two months and defying most of the market expectations.

The move comes as a surprise, as most analysts and surveys from major brokerage firms had predicted the central bank would keep the policy rate unchanged, while some had forecast a reduction of 50 basis points (bps). However, few had expected a cut as steep as 100 bps.

Explaining the move, the Monetary Policy Committee (MPC) said, “Inflation declined sharply during March and April, mainly due to a reduction in administered electricity prices and continued downtrend in food inflation.”

The central bank had cut the rate by 1,000 basis points since June from an all-time high of 22% before holding it in March, citing the risk of price rises, including from increased US tariffs.

Analysts also said that this measured cut would support economic recovery without undermining stability, given the large gap between interest rates and inflation, and improving but vulnerable external accounts.

The committee, which met today to review the monetary policy, added that the recent drop in core inflation also played a role. “Core inflation also declined in April, primarily reflecting favourable base-effect amidst moderate demand conditions,” it noted.

Overall, the MPC assessed that the inflation outlook has improved further relative to the previous assessment.

At the same time, the Committee viewed that the heightened global uncertainty surrounding trade tariffs and geopolitical developments could pose challenges for the economy.

In this backdrop, the MPC emphasised the importance of maintaining a measured monetary policy stance.

While reaching the decision, the Committee noted the following key developments since its last meeting. First, provisional real GDP growth for Q2-FY25 was reported at 1.7% year-on-year, whereas Q1 growth was revised up to 1.3% from 0.9%.

Second, the current account recorded a sizable surplus of $1.2 billion in March, mainly due to record-high workers’ remittances. This surplus and SBP’s foreign exchange reserves purchases partially cushioned the impact of large ongoing debt repayments on the central bank's reserves.

Third, recent surveys suggest further improvement in both consumer and business sentiments. Fourth, the shortfall in tax collection has continued to widen.

Lastly, global uncertainty, particularly around tariffs, has led the International Monetary Fund (IMF) to sharply downgrade its 2025 and 2026 growth projections for both advanced and emerging economies. The tariff uncertainty has also triggered heightened financial market volatility and a sharp decline in global oil prices.

The IMF will review a $7 billion bailout loan programme on May 9 and decide whether to disburse the first $1 billion. It will also discuss a new $1.3 billion climate resilience loan.

On balance, considering the evolving developments and risks, the MPC viewed that the real policy rate remains adequately positive to stabilise inflation in the target range of 5–7% while ensuring that the economy grows on a sustainable basis.

Real GDP growth was provisionally reported at 1.7% in Q2-FY25, bringing cumulative growth in H1-FY25 to 1.5%, in line with the MPC’s expectation.

Furthermore, incoming high-frequency indicators suggest that economic activity is maintaining momentum, as reflected by rising sales of passenger vehicles and petroleum products (excluding furnace oil), increasing electricity generation, and improving business and consumer confidence.

Nonetheless, the MPC observed that LSM outturns continue to remain below expectations.

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold