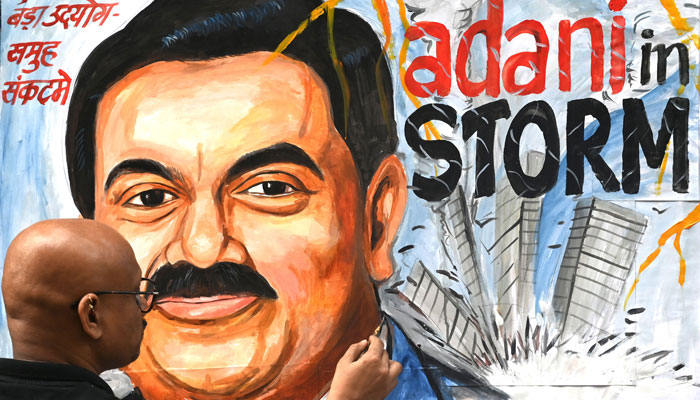

Indian Supreme Court denies new inquiry against billionaire Gautam Adani

Indian chief justice says there were "no grounds" for investigation to be transferred to special team

The Supreme Court of India has denied requests to form a new panel to look into fraud allegations made by a US investment research firm against the businesses owned by billionaire Gautam Adani, the BBC reported.

Hindenburg Research accused the firm of "brazen" stock manipulation and accounting fraud in January, last year, prompting a court committee, formed in March, to oversee an investigation by India's market regulator.

The Indian top court has requested the regulator to complete its investigation within three months after the panel stated in May that it had "drawn a blank".

Adani, who has always denied any wrongdoing calling the report "malicious", said "truth had prevailed" after the court's ruling.

Petitioners accused India's market watchdog the Securities and Exchange Board of India (Sebi) of not performing its duties properly and alleged that there was a "conflict of interest" among some members of the court-appointed panel investigating allegations.

Rejecting their plea, Chief Justice Dhananjaya Yeshwant Chandrachud said that there were "no grounds" for the investigation to be transferred to a special team and directed Sebi to complete its investigation promptly.

"The power to transfer investigation must be exercised in exceptional circumstances. Such powers cannot be exercised in the absence of cogent justifications," he said.

The court-appointed panel's members were not found to have a conflict of interest, and newspaper reports and third-party investigations cannot be used as conclusive evidence to challenge Sebi's finding, he added.

Hindenburg, a short-selling firm, accused Adani of "pulling the largest con in corporate history" by owning companies in offshore tax havens like Mauritius and the Caribbean.

The report also claimed Adani companies had "substantial debt", putting the entire group on a "precarious financial footing."

The Adani Group denied the allegations and said that it had always been "in compliance with all laws".

The allegations against Adani Group led to a market meltdown in India, with over $100 billion in market value wiped off their companies. However, their stocks have since rebounded and experienced a price increase before Wednesday's verdict.

Adani, one of the richest people in the world, is perceived as being close to Indian Prime Minister Narendra Modi and has been accused by opposition politicians of benefiting from his political connections, which he and Modi's party deny.

-

US lawmakers introduces new bill to define crypto market rules

-

Apple tops global smartphone market in 2025, says report

-

AI boom set to lift TSMC’s Q4 profit by 27%

-

An eye on 'global economic instability' as shares slumps, tensions intensify

-

Tesla dethroned: BYD shocks EV market as top seller in 2025

-

China sets up $8.9B fund to boost 2026 consumer goods trade-in

-

Meta to acquire Chinese AI startup Manus to expand advanced AI capabilities

-

China to roll out action plan for digital yuan expansion