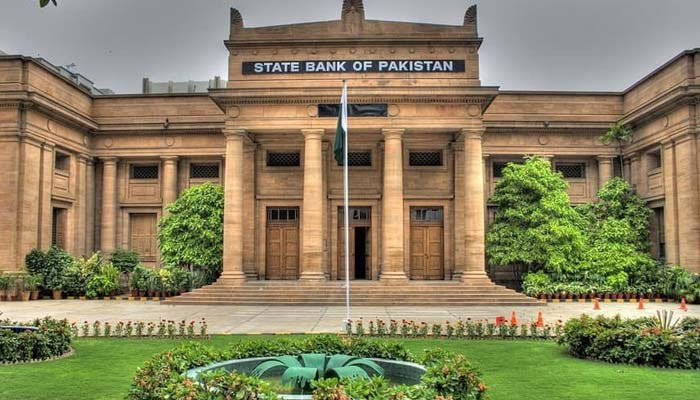

SBP further increases policy rate by 150bps to control inflation

Pakistan's central bank jacks up the benchmark policy rate by 150bps to 13.75% for the next six weeks

KARACHI: In a bid to maintain the balance between inflation and economic growth, the State Bank of Pakistan (SBP) on Monday raised the benchmark policy rate by 150 basis points to 13.75% for the next six weeks.

The central bank believes that this "effective action" was important to anchor inflation expectations and maintain external stability.

"This action, together with much needed fiscal consolidation, should help moderate demand to a more sustainable pace while keeping inflation expectations anchored and containing risks to external stability," the central bank said in its monetary policy statement (MPS).

The SBP has cumulatively increased the rate by 675 basis points since September 2021 to control inflation and narrow the current account deficit.

Hinting towards the next Monetary Policy Committee (MPC) meeting scheduled to be held on July 7, the SBP said: "Going forward, to strengthen monetary policy transmission, these rates will be linked to the policy rate and will adjust automatically, while continuing to remain below the policy rate in order to incentivise exports."

Inflation likely to increase 'temporarily'

According to the monetary policy statement, external pressures remain elevated and the inflation outlook has deteriorated due to both home-grown and international factors.

The Monetary Policy Committee (MPC) met for the first time under the leadership of acting governor Dr Murtaza Syed to take decisions regarding the key policy rate.

"Domestically, an expansionary fiscal stance this year, exacerbated by the recent energy subsidy package, has fueled demand and lingering policy uncertainty has compounded pressures on the exchange rate," the committee noted.

Moreover, globally, inflation has intensified due to the Russia-Ukraine conflict and renewed supply disruptions caused by the new COVID wave in China.

Consequently, the SBP noted that almost all central banks across the world are suddenly confronting multi-year high inflation and a challenging outlook.

"The MPC’s baseline outlook assumes continued engagement with the IMF, as well as reversal of fuel and electricity subsidies together with normalisation of the petroleum development levy (PDL) and GST taxes on fuel during FY23," the statement read.

The SBP highlighted that under these assumptions, headline inflation is likely to increase temporarily and may remain elevated throughout the next fiscal year.

"Thereafter, it is expected to fall to the 5-7% target range by the end of FY24, driven by fiscal consolidation, moderating growth, normalisation of global commodity prices, and beneficial base effects.

"Considering the balance of risks around this baseline, the MPC felt it was important to take effective action to anchor inflation expectations and maintain external stability," it added.

The MPC during the meeting emphasised the urgency of strong and equitable fiscal consolidation to complement today’s monetary tightening actions. This would help alleviate pressures on inflation, market rates and the external account.

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations