Auto industry welcomes Trump’s tariff relief with cautious optimism

Trump says changes aim to give manufacturers time to adjust without harming consumers

President Donald Trump has eased his administration’s aggressive tariff stance on the auto industry, offering carmakers a temporary reprieve that drew cautious praise from leading automakers and industry groups, Reuters reported.

In an executive order signed Tuesday, Trump introduced changes designed to reduce the impact of overlapping levies on foreign-made vehicles and parts.

The policy gives companies a two-year grace period to shift supply chains to the United States, with the aim of reducing American dependence on imported cars and components. Trump, visiting Detroit on his 100th day in office, framed the move as a short-term adjustment to help domestic firms adapt. “We just wanted to help them during this little transition,” he said.

Under the new rules, importers will no longer face simultaneous tariffs on finished vehicles and raw materials such as steel and aluminum. Instead, they will be charged the higher of the two. Additionally, importers assembling cars in the U.S. will receive partial offsets on vehicle prices over the next two years, designed to ease the financial burden during the transition.

Industry leaders, including the American Automotive Policy Council, which represents General Motors, Ford, and Stellantis, welcomed the announcement. Ford CEO Jim Farley said the decision would help mitigate tariff impacts on both manufacturers and consumers. General Motors also expressed interest in ramping up U.S. production.

The White House hopes the changes will drive a resurgence in domestic auto manufacturing, but analysts remain cautious. They warn that without long-term policy clarity, companies may hesitate to invest billions in new facilities. Half of U.S. car sales already come from vehicles assembled domestically, and firms like Nissan and Volvo have begun increasing U.S. investment.

Still, uncertainty looms as the full impact of the tariff modifications will depend on their longevity and enforcement.

-

Milo Ventimiglia recalls first meeting with Arielle Kebbel on the sets of 'Gilmore Girls' amid new project

-

Leading astrophysicist shot dead at southern California home

-

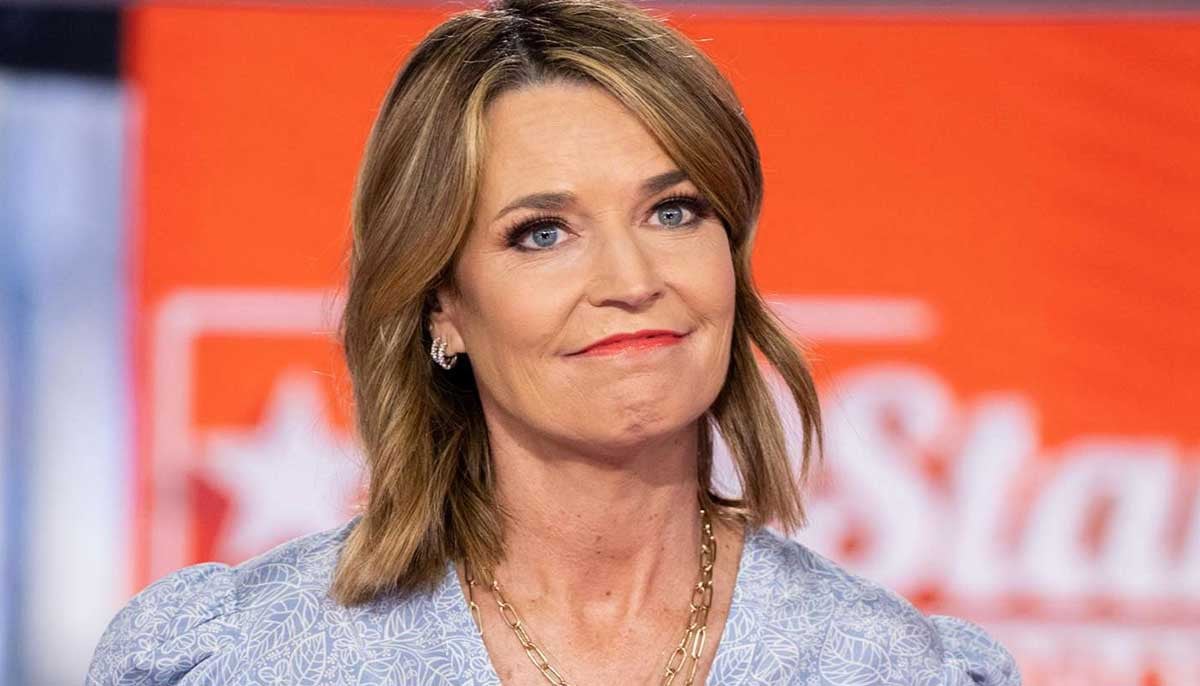

Will Savannah Guthrie ever return to 'Today' show? Here's what insiders predict

-

Amazon can be sued over sodium nitrite suicide cases, US court rules

-

Patrick Dempsey reveals Eric Dane's condition in final days before death

-

Epstein estate to pay $35M to victims in major class action settlement

-

South Korea’s ex-President Yoon issues public apology after being sentenced to life over martial law

-

Trump officially directs US agencies to identify and release files on extraterrestrial life