Rate cut bets push PSX near 89,000 points in extended record-breaking streak

Auto, banks, cements, and energy sectors witness robust buying activity

Pakistan Stock Exchange (PSX) pushed its record streak further, closing just beneath 89,000 points, as rate-sensitive sectors gained traction, spurred by strong hopes that the central bank is likely to continue its hawkish regime given disinflation and macroeconomic indicators that have finally started blinking green.

The PSX's benchmark KSE-100 Shares Index surged by 1751.45 to close at an all-time high of 88,945.98 points, up from the previous close of 87,194.53 points after touching an intraday high of 89,126 points.

With the first-quarter (1QFY25) corporate results rushing in, investors zeroed in on high-performing sectors such as auto-makers, cement, commercial banks, oil and gas exploration, oil marketing, and power generation.

Talking to Thenews.com.pk, Saad Ali, Director of Research at Intermarket Securities, said, "The PSX has been rallying since the approval of the International Monetary Fund's (IMF) $7 billion loan under Extended Fund Facility (EFF) spanning 37 months."

He said the recent political developments, such as the passage of the 26th Amendment, had given it an additional boost.

"Currently, the expectations of a 200bps (basis points) rate cut are further fuelling the rally," Ali added.

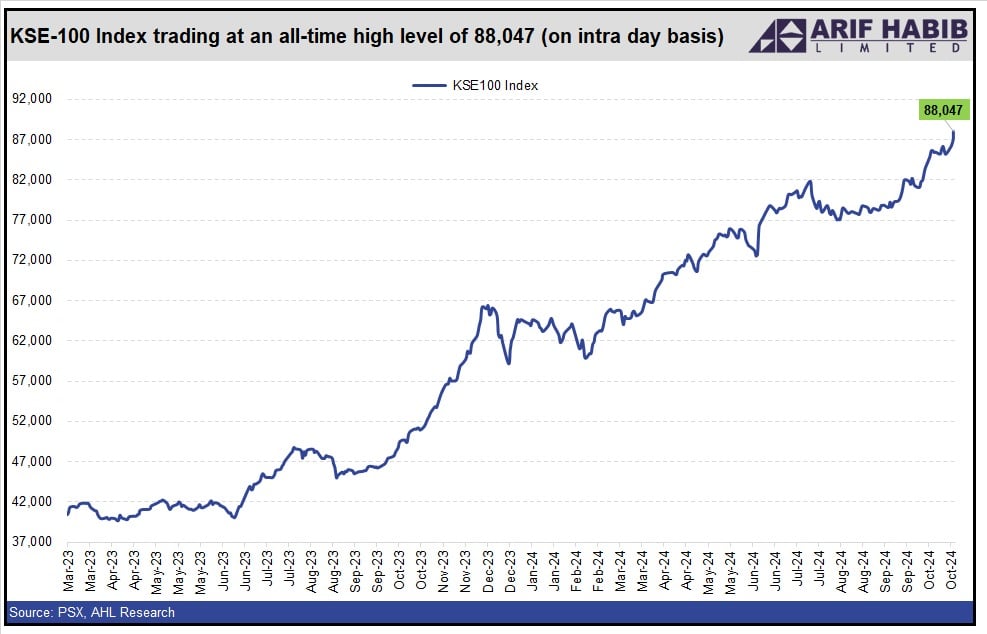

Brokerage Arif Habib Limited (AHL) in a note said the KSE-100 index crossed 88,000 points and "is trading at an all-time high level".

"This remarkable performance reflects a 41% gain CYTD (calendar-year-to-date) in 2024 and a month-on-month increase of 8.5% — making the PSX the 4th high-performing equity market in the world," the brokerage said.

State Bank of Pakistan's (SBP) Monetary Policy Committee (MPC) is slated to trim its policy rate by 200 basis points (bps) in its meeting on November 4, 2024, as inflation has been steadily declining in recent months.

Speculations have been doing rounds of a policy rate cut of up to 400 basis points by December, as according to analysts the room for easing exists, which has also rekindled foreign investors' interest in the country’s capital market.

Inflation dropped to 6.9% year-on-year in September 2024, the lowest since January 2021, down from 9.6% in August, driven by the high base effect, easing commodity and energy markets, and a stable currency, according to the Pakistan Bureau of Statistics (PBS).

In September, the SBP slashed the key policy rate by 200bps to 17.5% from 19.5%, citing a steep fall in both headline and core inflation over the past two months.

This is a developing story and is being updated with more details.

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold