US launches crackdown on cryptocurrency giants Coinbase, Binance

If SEC succeeds in these lawsuits, it could lead to increased regulation and oversight of cryptocurrency market

The US Securities and Exchange Commission (SEC) has taken legal action against two major cryptocurrency platforms, Coinbase and Binance, in an effort to regulate the largely unregulated crypto industry.

The SEC has filed a lawsuit against Coinbase, accusing it of operating as an unregistered securities exchange and evading investor protection regulations. Similarly, the SEC has sued Binance, the world's largest crypto exchange, for alleged violations of securities laws. If the SEC succeeds in these lawsuits, it could lead to increased regulation and oversight of the cryptocurrency market, which has operated outside of traditional regulations for years.

Coinbase, which serves over 108 million customers, has been accused of making billions of dollars by facilitating the buying and selling of crypto asset securities without proper registration. The SEC claims that Coinbase traded securities that should have been registered, including tokens like Solana, Cardano, and Polygon. Following the lawsuit, Coinbase experienced a significant outflow of customer funds, and its shares dropped. However, Coinbase has stated that it will continue operating as usual and emphasized its commitment to compliance.

Binance, on the other hand, has been accused of inflating trading volumes, commingling assets, and misleading customers about its controls. The SEC has filed a motion to freeze assets affiliated with Binance and its CEO Changpeng Zhao. Binance has strongly refuted the allegations, criticizing the SEC's lack of clarity in regulating the crypto industry. The lawsuit against Binance has also resulted in substantial customer fund withdrawals.

These legal actions by the SEC represent an escalation of its efforts to assert its authority over the crypto market. SEC Chair Gary Gensler has long maintained that tokens constitute securities and should be subject to regulations. The lawsuits against Coinbase and Binance mark the SEC's attempts to bring major players in the crypto industry under the jurisdiction of federal securities laws.

The outcomes of these lawsuits could have a significant impact on the crypto market and its future regulation. If the SEC prevails, it could transform the industry by establishing its authority and requiring compliance with securities regulations. However, the crypto industry has argued that tokens do not meet the definition of securities, and the SEC's attempts to regulate them exceed its authority.

The lawsuits against Coinbase and Binance highlight the ongoing debate and uncertainty surrounding the regulatory framework for cryptocurrencies.

-

'We were deceived': Noam Chomsky's wife regrets Epstein association

-

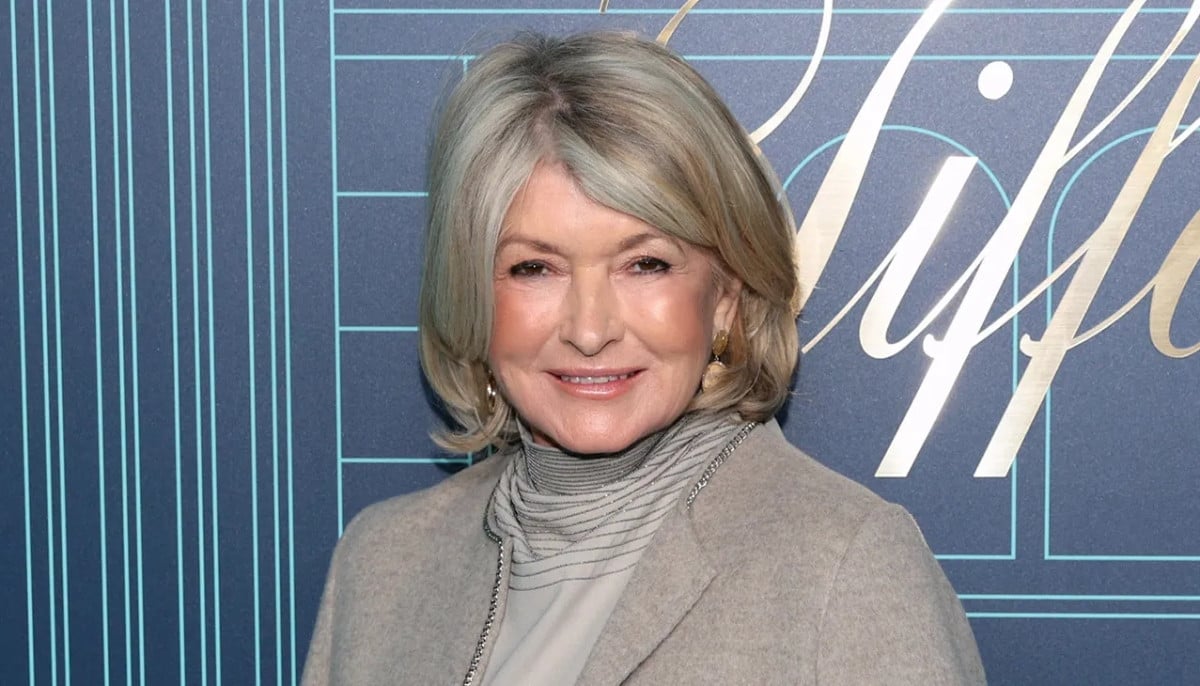

Martha Stewart on surviving rigorous times amid upcoming memoir release

-

18-month old on life-saving medication returned to ICE detention

-

Cardi B says THIS about Bad Bunny's Grammy statement

-

Chicago child, 8, dead after 'months of abuse, starvation', two arrested

-

Funeral home owner sentenced to 40 years for selling corpses, faking ashes

-

Australia’s Liberal-National coalition reunites after brief split over hate laws

-

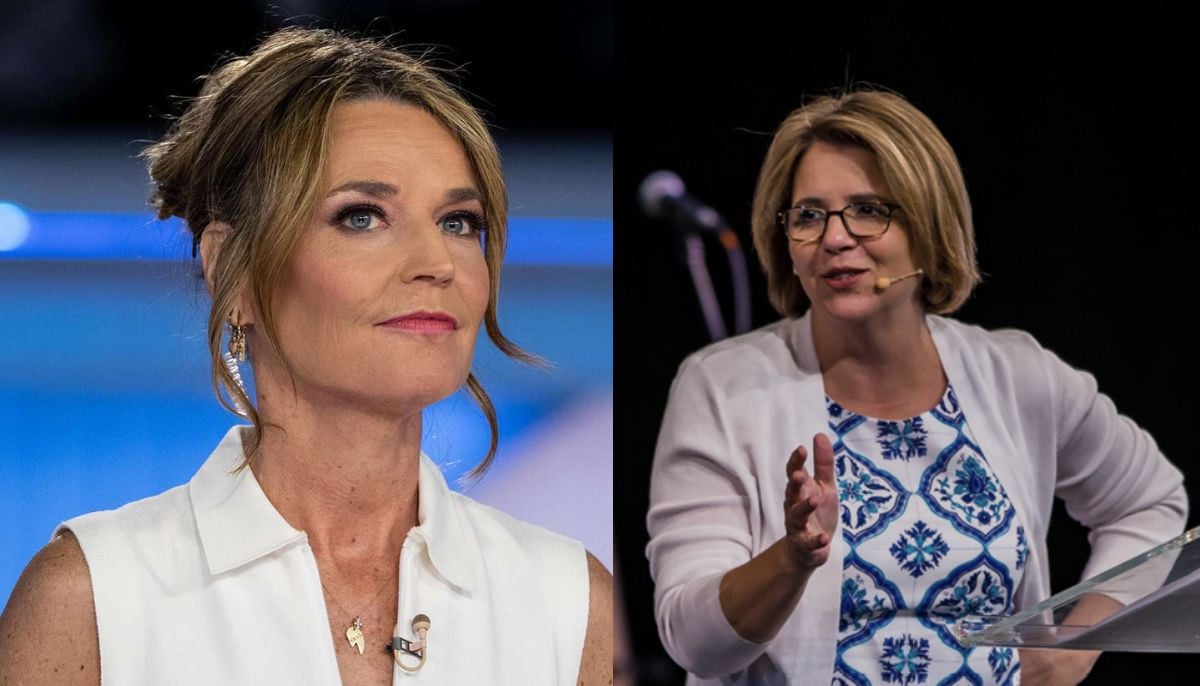

Savannah Guthrie addresses ransom demands made by her mother Nancy's kidnappers