INSIGHT

Pakistan Stock Exchange (PSX) 100-index has achieved another milestone by being bullish to cross 50,000- point level last week and has been termed as one of the fastest growing markets in South Asia by local and foreign business and financial publications.The index has been on a growth trajectory following the reports of MSCIs decision started making the rounds. The World Bank, internationally acknowledged Moody’s credit rating agency and a number of foreign media outlets have given positive reviews of the bulging Pakistani stock market.

However, there is a growing perception that increase in KSE 100-index is not at all a barometer for gauging improvements in the country’s economy, and that other factors need to be considered and implemented to achieve major economic objectives including sustainable GDP growth.

However, there is a growing perception that increase in KSE 100-index is not at all a barometer for gauging improvements in the country’s economy, and that other factors need to be considered and implemented to achieve major economic objectives including sustainable GDP growth.

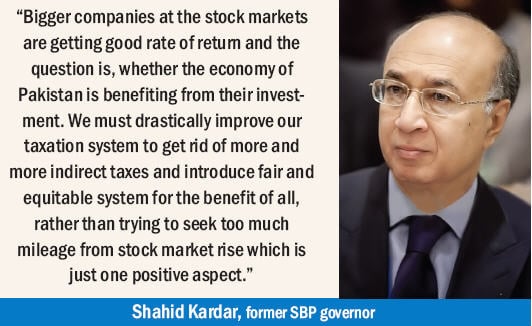

Former central bank governor Shahid Kardar believed that the stock market was thriving on speculations and it has nothing to do with the real economy. “Bigger companies at the stock markets are getting good rate of return and the question is, whether the economy of Pakistan is benefiting from their investment,” he asked.

The most important issue, he pointed out, was to ensure efficiency and the competitiveness of the public and private sectors without which there could not be any real economic turnaround in the country. “You have to improve the productivity of industries as well as the companies and this will come only when you do away with the culture of SROs,” he added.

Kardar regretted that there was too much focus on the stock market, while there was no attention on improving socioeconomic indicators required to bring certain change in the life of a common man. “We must drastically improve our taxation system to get rid of more and more indirect taxes and introduce fair and equitable system for the benefit of all, rather than trying to seek too much mileage from stock market rise which is just one positive aspect,” the former governor of the State Bank of Pakistan (SBP) said.

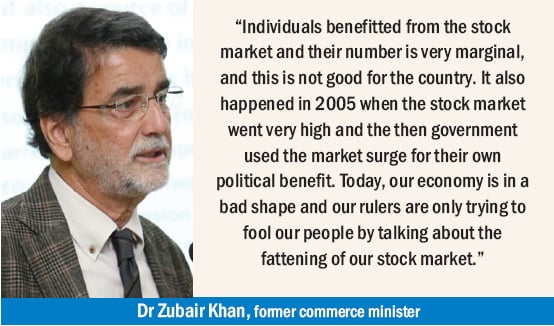

Former commerce minister in the Musharraf government, Dr Zubair Khan wondered why no new market players and companies were entering the Pakistani stock market, and why 100-index was still on the rise. Bigger shares holders had monopoly in the stock market, he said, they were involved in buying and selling at the cost of smaller investors.

“I as an economist firmly believe that rise in 100-index has no economic significance, as only tax evaders, now seen more in the real estate business, are investing in the stock market,” he said.

Economic fundamentals did not improve that was why people always preferred to invest in the stock market. Therefore, this phenomenon cannot be termed a real economic activity. “Individuals benefitted from the stock market and their number is very marginal, and this is not good for the country.”

It also happened in 2005 when the stock market went very high and the then government used the market surge for their own political benefit. “Today, our economy is in a bad shape and our rulers are only trying to fool our people by talking about the fattening of our stock market,” he added.

Details, both official and unofficial reveal that $150 million portfolio investment went out of the stock market during the last six months (July-December). Why did that happen needs to be answered by someone in the government whose critics claim the economy is no more seen on the radar screen.

It is no secret that more and more money is coming in the country through infamous hawala and hundi from abroad which is being invested in the stock market only to be whitened quickly. There are more outflows of funds than inflows, which has empirical evidence as well. Ever since the Pakistan Muslim League-Nawaz (PML-N) government imposed new taxes on the real estate sector in the current budget, here has been increased investment in the stock market.

The country’s benchmark index rose to three percent in trade, climbing to a record high in June last year after the stock market was reclassified overnight and included in the MSCI’s emerging market index category.

After that Pakistani brokerages upgraded their outlook on the market having a main index rising to above 40,000 by the end of the last year. The concerned officials have been saying that improved outlook was possible after the government introduced a number of reforms that helped regain the confidence of both local and foreign investors.

The Karachi Stock Exchange 100-index is a major stock market index which tracks the performance of the largest companies by market capitalisation from each sector of the Pakistani economy listed on the KSE, which traded at 49,757 on January 25 last. Historically, the Pakistan Stock Market (KSE100) reached an all- time high of 49,968.92 in January of 2017 and later surpassed 50,000- on January 26th after a record low of 538.89 in June 1990.

Interestingly, there are said to be two dozen major investors in Karachi and about a dozen in Lahore who are considered real market players in terms of successfully engaging in buying and selling, while small investors hardly gain at the end of the day.

There are private companies and major public sector companies whose shares are traded every day. As far as State Owned Enterprises (SOEs) are concerned, hardly few of them are making money and their shares are bought or sold. These also include, Pakistan State Oil (PSO), Sui Southern and Sui Northern gas companies, Oil and Gas Development Corporation Limited (OGDCL), whose shares are better traded at the stock market, while others including those making losses, are continuing to drain the national exchequer.

There are private companies and major public sector companies whose shares are traded every day. As far as State Owned Enterprises (SOEs) are concerned, hardly few of them are making money and their shares are bought or sold. These also include, Pakistan State Oil (PSO), Sui Southern and Sui Northern gas companies, Oil and Gas Development Corporation Limited (OGDCL), whose shares are better traded at the stock market, while others including those making losses, are continuing to drain the national exchequer.

Most of the SOEs are incurring heavy losses and as such their privatisation needs to be stepped up in order to stop spending on their accumulated liabilities and meeting their losses.

The matter began to go soar when the losses of three major SOEs – Pakistan Steel Mills, Pakistan International Airlines, and Pakistan Railways, surged to Rs705 billion in three years. This is in addition to Rs660 billion debts piled up on account of the power sector, of which Rs348 billion has been accumulated in three years, even though there were repeated increases in consumers’ tariffs.

This all happened despite the fact that the revival of loss making state units was one of the central themes of the three years economic reform programme. The cumulative losses increased in these three SOEs and power sector companies to Rs1.365 trillion, which is more than the country’s consolidated annual development programme of Rs1.25 trillion for the current year.

According to the International Monitory Fund (IMF), losses of the natural gas sector increased to 11.5 percent in three years, showing an increase of 1.4 percent since the government opted for the IMF’s three year lending programme in September 2013. Power sector (PEPCO), Pakistan Railways, Pakistan Steel Mills, Utility Stores Corporation (USC), Trading Corporation of Pakistan (TCP), Pakistan Storage and Supplies Corporation (PASSCO) and National Highway Authority (NHA) continued to incur losses. This also includes major losses incurred on account of power subsidies amounting to Rs1,100 billion.

Meanwhile, the remaining SOEs have caused a financial loss of Rs400 billion during the last four years. The PML-N government has added Rs255 billion to losses and debt of public sector enterprises. According to the central bank, debt and liabilities jumped to Rs793.3 billion in June 2013.

Sad part of the situation is that the government failed to turn around SOEs through restructuring as was promised in the 2013 general election. In contrast, there was an annual increase in public sector enterprises’ debt, from Rs312 billion during 2013 to Rs568 billion at the end of 2016. Liabilities of these enterprises were largely stable at Rs225.2 billion in 2016 as opposed to Rs226 billion in 2013.

Minister for privatisation Muhammad Zubair is on record; having said that disinvestment of public sector was a big challenge due to various reasons, including the complicated privatisation process and the opposition by the political parties. He had also acknowledged that an independent decision making power was needed to implement the government’s privatisation programme.

Nonetheless, it is often said that there is no justification to spend the tax payers’ money on keeping loss making entities afloat and that the government must get rid of them as quick as possible by creating some enabling environment.

The classic example is that of the steel mills that is incurring unprecedented losses for the last many years and its management needs to be replaced by competent  and honest people.

and honest people.

Had it been privatised back in 2006, it would have fetched $361 million, which it can only dream of now due to unchecked corruption, inefficiency, over-employment and lukewarm attitude of the successive governments.

The mill briefly started giving profit during its one able chairman late Col Afzal who remained there during 1999-2003 and successfully achieved the restructuring of the mills by offering voluntary retirement scheme to 10,500 employees at the cost of Rs7.5 billion. The late chairman also returned Rs12 billion (both loan and interest payment) to the banks, besides giving Rs1 billion dividend to the shares holders.

But now the mills’ losses incurred from July 2008 to December 2015 along with its liabilities have reached Rs415 billion, mainly because of low production and the non-availability of raw material. An official report suggested that if $900 million (Rs90 billion) were spent, the production capacity could be increased from 1.1 million tons to 3 million tons and that the Pakistan Steel Mills could be made profitable. The mills’ capacity has not been enhanced from 1.1 million tons to 3 million tons even in 44 years.

“Right now, it is facing financial bleeding worth Rs3 million per hour, but the both the federal and provincial governments are keeping quiet because of their own vested interests,” an insider said.

If loss making state enterprises were either privatised or made viable and profitable, the government would not only save Rs800 billion annually but could also attract increased portfolio investment in the stock market.

The writer is a senior journalist based in Islamabad