INSIGHT

The International Monitory Fund’s (IMF) prescribed preference of fiscal consolidation over growth did not yield enough results to help improve key macroeconomic indicators, including poverty and unemployment that may cause problems to the government to win the coming elections.

Now, when the next polls are around the corner, there is a wake-up call for the incumbent prime minister, already facing a tough time over Panama leaks scandal, as fundamental goals and objectives have not been adequately achieved, except for inaugurating roads and transportation projects. Rampant poverty, budding unemployment particularly among the youth, unavailability of sufficient education and health services, skill development, and social safety net are some of the important areas that remained grossly neglected by the state during the last four years. Pakistan is ranked 146th on per capita income basis and 147th on the human development index; and who does not know that human resources of Pakistan are grossly wasted and abused by the state.

Now, when the next polls are around the corner, there is a wake-up call for the incumbent prime minister, already facing a tough time over Panama leaks scandal, as fundamental goals and objectives have not been adequately achieved, except for inaugurating roads and transportation projects. Rampant poverty, budding unemployment particularly among the youth, unavailability of sufficient education and health services, skill development, and social safety net are some of the important areas that remained grossly neglected by the state during the last four years. Pakistan is ranked 146th on per capita income basis and 147th on the human development index; and who does not know that human resources of Pakistan are grossly wasted and abused by the state.

Both the Pakistan Muslim League-Nawaz (PML-N) government and the previous Pakistan Peoples’ Party government focused on fiscal consolidation through austerity over inclusive growth, which brought average growth rate of 3.4 percent during 2008-09 to 2015-16, and failed to create enough jobs to remove speedily increasing poverty across the country.

And this should be the biggest worry for the official planners that unemployment rate rose to 13 year high at eight percent, while youth unemployment rate surged close to 12 percent by 2014-15. The scourge of poverty has not reduced rather it continues to increase despite tall claims that are being made by the rulers. There is a need for a minimum three million jobs on a yearly basis to achieve double digit GDP growth rate in the foreseeable future.

Today, over 50 percent of the population is living below the poverty line, surviving on just two dollars a day, and questions are generally being asked as to where are the Rs120 billion going, which are allocated every year for the poorer segments of the society under the Benazir Income Support Programme (BISP). Reputed Pakistan Muslim League-Nawaz Senator Anwar Baig, who was appointed the chairman of the BISP, had resigned after few months because of the alleged corruption in the programme, which was said to be taking place with the connivance of the high-ups.

Widespread poverty and swelling unemployment, coupled with shrinking health and education services is a matter of concern for everybody, including many of those sitting in the ruling party who admit that their government did not do much to improve the much needed socio-economic indicators aimed at winning the next election.

The question being discussed in the official and unofficial quarters is why the government preferred stabilisation over growth, and in the pursuit of the process, failed to achieve both the objectives. Fiscal deficit which went down to three percent has risen again and is likely to end up between 5.5 percent and six percent of the GDP in 2016-17. This is largely due to falling revenues and over borrowing, which also included more than Rs1 trillion alone from the State Bank of Pakistan (SBP). The stabilisation policy is also known as anti-growth.

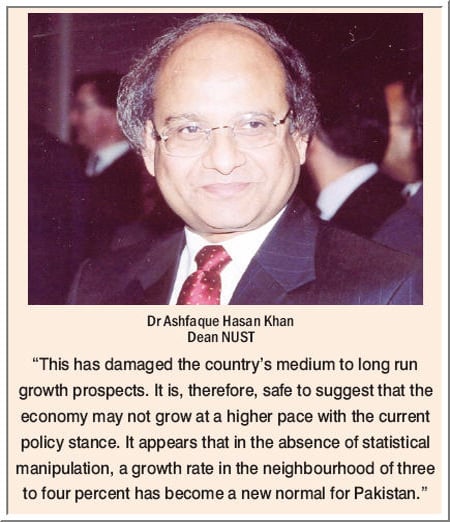

According to Dr Ashfaque Hasan Khan, the principal and dean, School of Social Sciences and Humanities, National University of Sciences and Technology (NUST), Islamabad as well as a member of the government’s Economic Advisory Council, Pakistan continued to pursue, by and large, the stabilisation policy of the 1980s vintage as propagated by the IMF, since 2008 and until today. Such a prolonged period (eight years) of stabilisation or austerity or anti-growth policy, he said, has suffocated the economy and severely constrained growth potential with attendant rise in socio-economic challenges for the country.

“This has damaged the country’s medium to long run growth prospects. It is, therefore, safe to suggest that the economy may not grow at a higher pace with the current policy stance. It appears that in the absence of statistical manipulation, a growth rate in the neighbourhood of three to four percent has become a new normal for Pakistan,” he said.

Like Dr Khan, other independent economists also believe that Pakistan had to pay a heavy price for pursing a stabilisation path against growth trajectory. They all urge it to be changed so that the country’s two major issues – poverty and unemployment -- could effectively be addressed along with building human capital that requires more spending for health, education and social safety nets. Once these objectives are achieved to some major extent, only then should the government go for replacing the current weak and decaying infrastructure, which mainly includes highways, roads, energy, communications, ports and shipping, and water reservoirs.

There is a widespread notion that the multilateral agencies had been proposing cut in fiscal deficit through austerity in the name of stabilisation for countries like Pakistan. These agencies view inclusive growth a recipe for disaster without fiscal stabilisation, the major objective of which, according to independent economists, is to ensure the recovery of their own loans along with interest rather than developing human capital by promoting growth that seeks more spending.

The idea of fiscal stabilisation now amply shows that it has restricted both public and private investment; resultantly the country is struggling to improve its macroeconomic framework and hence failing to cater to the requirements of the middle and lower income groups in terms of removing poverty and generating enough jobs.

Under the advice of the IMF, the government embarked on a path of restricting its spending, cutting development budgets, denying Rs200 billion sales tax refunds to the exporters and ensuring financial discipline by the provinces. However, at the end of the day, one finds that fiscal deficit and inflation are once again on the increase, while the government’s borrowing is reaching record high, making the current budget unsustainable.

Since the government failed to strike balance between the income and expenditure, it was left with no option but to recklessly borrow from all sources, including the private banks which led to swelling of both fiscal deficit and public debt that are approaching alarming levels. Unfortunately it has happened at the cost of growth, which reached 4.5 percent of GDP last year after languishing at three or less than three percent for many years.

All this demands some corrective fiscal policies with an aim to ensure prudent spending and fiscal discipline by the provincial governments, which after the passage of the 18th Amendment to the Constitution have been refusing to accept any genuine advice given by the federal planners.

The government’s failure in devising a national strategy has been a major reason behind today’s yawning economic problems, which keep getting compounded with the passage of time. Gone are days when the Planning Commission used to provide able leadership to formulate genuine socio-economic goals and resist undue financial demands of the federation and its federating units.

The role of the Planning Commission was largely compromised during two each previous PML-N and PPP governments when the concerned officials were forced to look after the political interests of the ruling parties. As once being vibrant, people used to look towards the Planning Commission and not the ministry of finance. Since the commission is no more independent, economists and experts had been urging the successive governments to wind it up as being “ineffective” in terms of proposing genuine development projects on merit.

Earlier, the Planning Commission used to decide the size of the development budget. Now, it cannot touch it, as it has become the sole domain of the Ministry of Finance, whose officials only oblige the prime minister and his party’s national and provincial legislators by offering them more and more development budget and that too without any accountability.

Earlier, the Planning Commission used to decide the size of the development budget. Now, it cannot touch it, as it has become the sole domain of the Ministry of Finance, whose officials only oblige the prime minister and his party’s national and provincial legislators by offering them more and more development budget and that too without any accountability.

It is a shame that ministers of the national assembly use their influence, and even bribe the officials concerned to seek an increased development budget, which then is not spent where it is supposed to be utilised. Their constituencies remain inadequately supplied, and it appears that the people who pay taxes are only benefitting the legislators and political governments in Pakistan. Businessmen and traders also using the same argument ask why they need to pay any taxes if those taxes end up being misused.

On top of all this, the irony is that people are still being burdened with more and more taxes with each passing year besides the 70 percent indirect taxes they already pay to the government on buying even a matchbox or eggs. Each year, people end up paying countless indirect taxes under various heads.

Now that the new budget exercises will start soon, finance minister Ishaq Dar is understood to have directed the officials of the Federal Bureau of Revenue (FBR) to prepare some robust plan to enhance direct taxes. The Economic Survey 2015-16 concedes Pakistan’s tax structure is highly dependent on indirect taxes. It said that the proportion of direct taxes has gradually risen, which now account for 68.5 percent of the total taxes collected by the FBR in the financial year 2006 came down to 60 percent in 2015. On the other hand direct taxes increased from 32 percent in 2006 to 40 percent in 2015, having 60:40 ratio but the government’s critics estimate the ratio is 70:30 and that the government is not telling the truth to the people.

More worries are appearing in the shape of increased government contingent liabilities after giving sovereign guarantees one after the other for state corporations seeking foreign loans. The latest is Pakistan International Airlines Rs161 billion liabilities that were given as the government’s sovereign guarantee last week. Overall, these guarantees worth Rs872 billion relating to Public Sector Enterprises (PSEs) had been given by the government which have reached 2.4 percent of the GDP against two percent limit allowed by Fiscal responsibility and Debt Limitation act of 2005. Likewise power sector sovereign guarantees given by the government have risen to Rs1,600 billion. In addition to that, commodities financing contingent liabilities have grown to Rs636 billion.

The latest is that such government guaranteed sovereign liabilities are now being offered to Chinese companies investing in China-Pakistan Economic Corridors (CPEC) projects. “These sovereign guarantees are being given by the government outside the budget and it simply means chickens are coming home to roost,” said a former finance minister. He saw a balance of payment crisis coming and said that it was an eye opener the way the government had to pay back $500 million to China (kept in safe deposit) which continued to drag for additional three years. “This shows that the government is facing difficulties to honour its commitment,” he said.

The writer is a senior journalist based in Islamabad