How the world is responding to the coronavirus pandemic with gold

Globally, the gold rates continue rising, heading for a $1,900 mark

With the coronavirus pandemic showing no signs of slowing down around the world, infecting millions and killing hundreds of thousands of people, The News looks at the positions various countries have taken in terms of increasing or decreasing their gold reserves.

Before going into the data, it is important to remember that the yellow metal is viewed as a safe bet during crises and therefore, centrals banks around the world added 650 tonnes of gold to their reserves over the past one year.

The high value — which may differ in June 2020 statistics — reflects the seriousness of the coronavirus pandemic.

Why do central banks keep gold reserves? Because bullion is relatively safe to invest in as it can withstand political or economic changes better compared to other metals, currencies, and stocks. It is also more liquid, thereby allowing countries to convert it to cash should the need arise.

Gold rates have also been on a persistent rally since quite a while, reaching new levels and even breaking past the nine-year high earlier. In Pakistan, on Thursday, gold shot up to an all-time high of Rs117,300 a tola, whereas the price of 10 grammes rose Rs1,972 to Rs100,566.

Globally, the gold rates have gone up to $26 an ounce to almost $1,882. The precious metal has been staying above $1,800 in the global markets — close to nearly the nine-year peak hit in the previous session — as fears of economic stagnation grew owing to the skyrocketing coronavirus cases.

On a year-to-date (YTD) basis, only two central banks — that of Turkey and Uzbekistan — have bumped up their reserves significantly, by 36.8 tonnes and 6.8 tonnes, respectively, according to the data from the International Monetary Fund (IMF) and published on the World Gold Council's (WGC) website.

"In May, only Mongolia saw their gold reserves decline significantly, by 3.3t. On a y-t-d basis, six central banks have now decreased their gold reserves, totalling 31.8t," it says.

According to the WGC's mid-year outlook 2020, gold has had "a remarkable performance, increasing by 16.8% in US-dollar terms and significantly outperforming all other major asset classes".

"By the end of June, it was trading at US $1,770/oz, a level unseen since 2012," the international body notes.

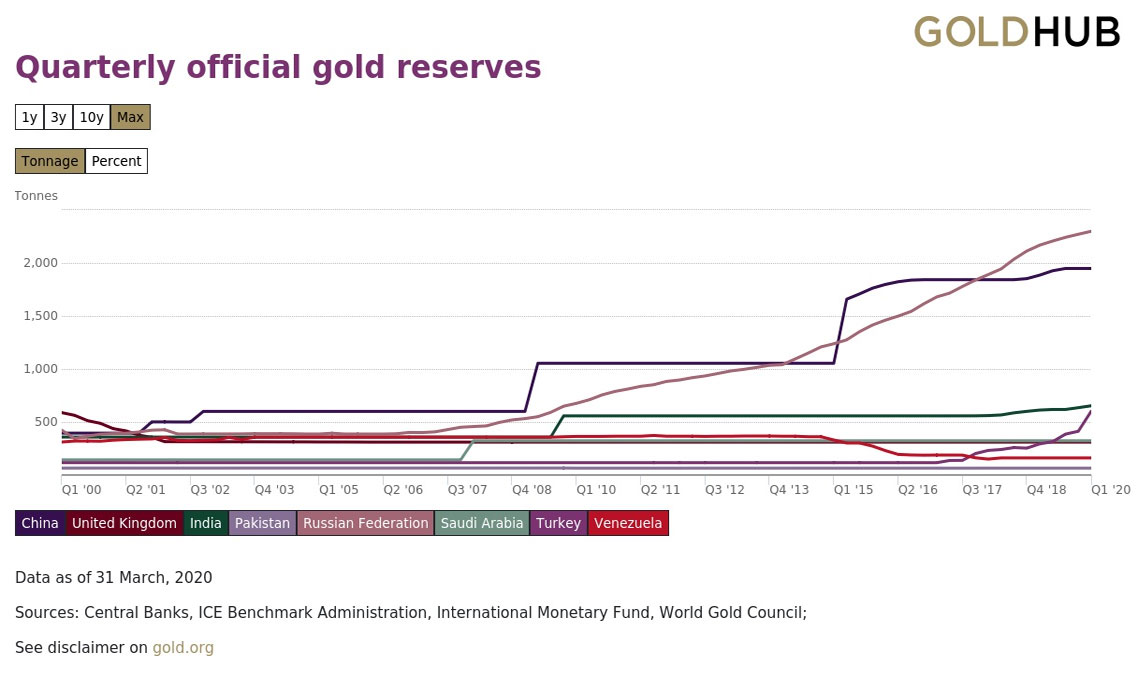

Data from the WGC shows that as of March 31, 2020, and June 2020 for the countries that reported second-quarter figures as well, the situation of reserves around the world is as follows:

• US: 8,133 tonnes (highest in world; majority or 79% of foreign reserves)

• Russia: 2,299 tonnes (22.6% of its foreign reserves)

• China: 1,948 tonnes (3.1% of its foreign reserves)

• India: 654 tonnes (7.5% of its foreign reserves)

• Turkey: 601 tonnes

• Uzbekistan: 338 tonnes

• Saudi Arabia: 323 tonnes

• UK: 310 tonnes

• Venezuela: 161 tonnes

• Pakistan: 65 tonnes

As per a report in TRT World, Turkey’s Central Bank has purchased 148 tonnes since the start of this year, making it the biggest gold buyer.

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations