G20 nations should provide debt relief to poorest counterparts, says World Bank economist

World Bank chief economist Carmen Reinhart also cautioned against confusing 'rebound with recovery'

WASHINGTON: It is crucial for the G20 countries to provide debt relief to the poorest nations across the globe, the World Bank's top economist said Friday, as the ongoing coronavirus pandemic rages on and true economic recovery remained "in the distant future".

Cautioning policymakers not to "confuse rebound with recovery," newly-installed World Bank chief economist Carmen Reinhart called for an extension to the existing debt moratorium.

G20 finance ministers are set to hold a virtual meeting Saturday wherein they are expected to discuss the status of the debt relief initiative.

She called the initial step "useful" but said, "Sadly, that step hasn't gone as far as it has been hoped.

"We are still awaiting private sector participation and the participation of members outside the Paris Club. It also has not been as extensive as hoped."

Governments in more developed nations need to have "the willingness to do something more encompassing" that includes "a greater share of the emerging markets, as well as the developing countries."

But Reinhart said she is "somewhat skeptical," and noted that China is a bigger creditor than the rest of the Paris Club combined, but offers little transparency on the amount of debt or relief being given.

She also called on the private sector to do more.

'Deep economic downturn'

The Group of 20 governments in April agreed to a one-year debt standstill that the IMF and World Bank had pushed for to help the 76 most vulnerable economies and called on private creditors to join in.

But the Institute of International Finance — a global private banking group — this week issued a progress report on the debt standstill for private creditors, which noted that only a few borrowers have approached creditors with informal requests to avail themselves of the relief.

Reinhart said she also is concerned about "the disconnect between the raging COVID pandemic" with its serious impacts on economic activity and the behavior of financial markets, which have not reflected the "depth and duration of the deep economic downturn that we're in."

Stock markets have been buoyed in recent weeks by signs of resurging activity as economies have begun to reopen, but Reinhart said, "I think we have a tendency to confuse rebound, with recovery, a rebound after a collapse."

While output has bounced back, that "is not the same as true recovery" which remains "in the distant future."

-

Dog dies after Florida woman allegedly sets neighbour’s house on fire

-

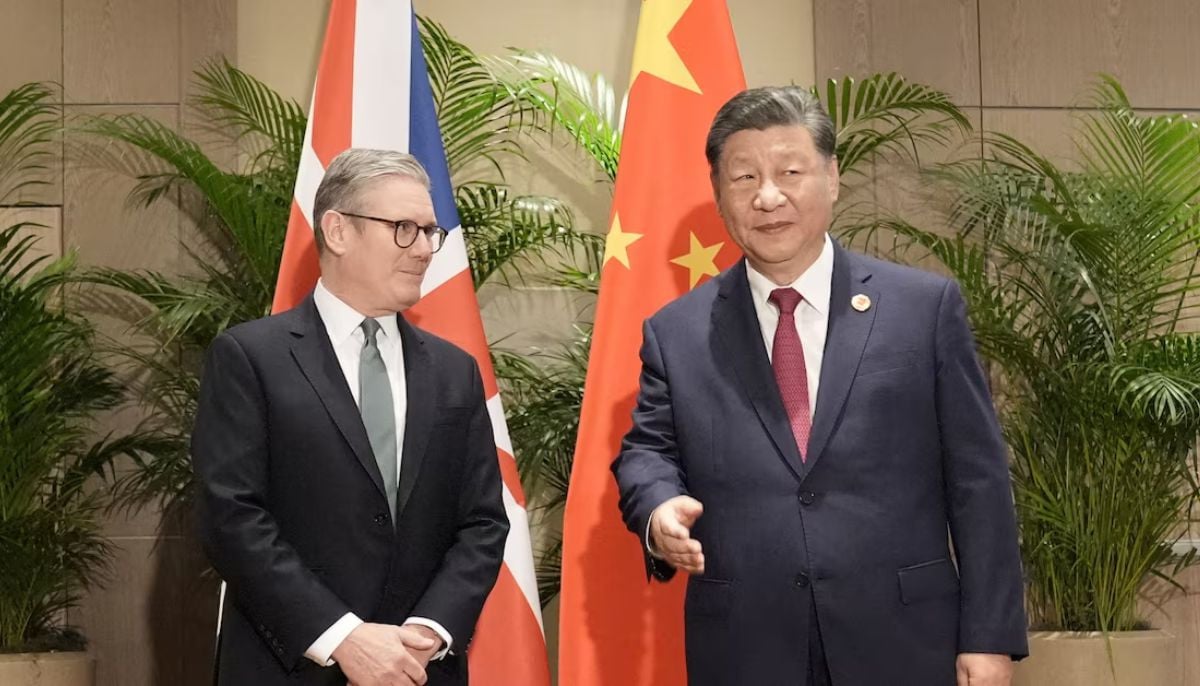

Reviving the ‘Golden Era’: How the new UK-China partnership seeks to strengthen bilateral economic ties

-

Trump launches ‘Board of Peace’ in Davos: Inside governance, mandate & members

-

Davos: Elon Musk’s surprise addition to the schedule draws global attention

-

World's oldest artwork: 68,000 year-old cave paintings discovered in Indonesia

-

Spain calls for EU joint army after Trump’s declaration of Greenland deal

-

US to exit WHO: A seismic shift in global health?

-

Trump backs off European tariffs threat after reaching ‘framework of a future deal’ on Greenland with NATO