Details of taxes imposed on mobile phones in mini-budget

Tax details on mobile phones: Cellular mobile phones or satellite phones to be charged on the basis of import value per set, or equivalent value in rupees in case of supply by the manufacturer. Finance Supplementary Second Amendment Bill 2019 has proposed to increase the duty on expensive sets only.

Finance Minister Asad Umar on Wednesday presented mini-budget in the National Assembly jacking up tax on import of high-end user mobile phone sets.

Presenting the Finance Supplementary (Second Amendment) Bill, 2019 approved by the Federal Cabinet earlier today, Asad Umar said it was not a mini-budget but rather a set of economic reforms.

According to the document, Cellular mobile phones or satellite phones to be charged on the basis of import value per set, or equivalent value in rupees in case of supply by the manufacturer.

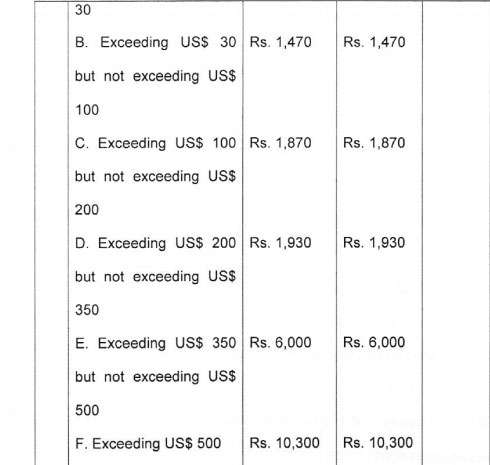

Mobile Value and Tax in Rupees

Mobile Phone not exceeding $30 (Rs.150)

Mobile Phone exceeding $ 30 but not exceeding $ 100 (Rs. 1,470)

Mobile phones exceeding $100 but not exceeding $200 (Rs. 1,870)

Exceeding $ 200 but not exceeding uS$ 350 (Rs. 1,930)

Exceeding $ 350 but not exceeding US$ 500 (Rs.6,000)

Exceeding $ 500 (Rs. 10,300)

Meanwhile, Federal Board of Revenue Combine Tax will be applicable on imported mobile phones.

Member policy FBR while briefing in Islamabad gave details of the imported cellular phones.

According to details, Rs 400 tax will be applicable on mobile phones worth Rs10,000; Rs4000 tax on phones of price Rs28,000; Rs6000 tax on phone worth Rs60,000; Rs8000 tax on phone worth Rs105,000 and Rs23000 tax on the phones worth Rs150,000 while Rs41,000 tax on the phones worth more than Rs150,000.

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates