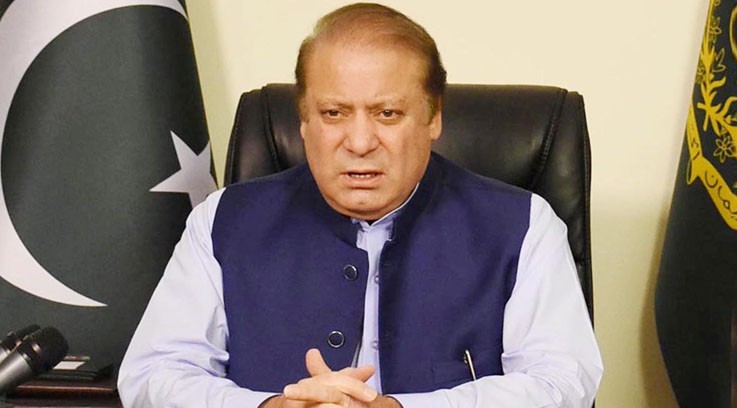

The prime minister is under moral and legal obligation to clear the names of his children after Panama Papers

Offshore companies are used for legitimate reasons. It may be used for illegitimate reasons -- Wolf in sheep’s clothing: Common abuses of offshore jurisdictions by Mikhail Lastovsky in GRC & Fraud Software Journal

The Panama Papers are not just about tax evasion. They’re not even about money. What the Panama Papers really depict is the corruption of our political system that allows the rich and powerful to get away with plunder -- Probing ‘Panamagate’ by Zahid Hussain

Sharif and members of his family have always denied any wrongdoing, and none have ever been convicted of any offence. Supporters say the charges against them are politically motivated. It is not illegal to own property through an offshore company -- Pakistani PM’s children raised £7m against UK flats owned offshore, The Guardian, April 5, 2016

In the wake of Panama Papers, implicating the close family members in offshore companies, Nawaz Sharif has offered investigation/accountability through a judicial commission to be established under Pakistan Commissions of Inquiry Act 1956. On the other hand, all major opposition parties on May 3, 2016, after two days’ parleys, demanded inquiry under a special law, ‘Panama Papers (inquiry and Trial) Act 2016’, by a Commission to be formed, headed by Chief Justice of Pakistan, and comprising two other judges of Supreme Court nominated by him.

The issue of inquiry/resignation/disqualification can be settled considering the following facts emerging from Panama Papers and papers filed by Nawaz Sharif before the Election Commission of Pakistan for contesting elections in 2013:

Admitted/Incontrovertible facts

Offshore companies are managed by the offspring of prime minister

Properties in London are owned through offshore companies

Loans have been obtained using properties owned by offshore companies

Loan payments were made abroad

Issues/Implications

(a) Moral

(i) Shelter of offshore companies should not be taken by public office holders

(ii) Argument of compulsion of doing business abroad by offspring is untenable as sons of chief minister of Punjab are doing business in Pakistan

(b) Political

(i) Question of accountability within political parties

(ii) Head of party enjoys unfettered/unchallenged powers. He is not subjected to any inquiry/accountability within the party. This applies to all political parties in Pakistan.

(c) Legal provisions -- Constitution/Election Laws

(i) Article 62(f)(d)/63(q)(r) of Constitution

(ii) Section 12(2)(c)(d) of Representation of People Act, 1976

Various provisions of the Income Tax Ordinance, 2001

Ss. 90/91 Transfer of assets

S. 85(3)(a)--"Associates" include relatives.

Transactions between "associates" section108

Section 109: Tax avoidance scheme is no longer permissible

Section 111 for unexplained money, investment, expenditure etc.

According to record of Federal Board of Revenue (FBR), Nawaz Sharif was allotted National Tax Number [0667649-9] on November 15, 1995. In 2012, he showed total net wealth at Rs244,995,207. Annual expenses in 2012 were shown at Rs24,096,786. No asset was declared in the name of any dependent and no liability was shown. However, in 2011, land worth Rs24,851,526 was declared in the name of daughter (Maryam Safdar) as dependent!

There is non-disclosure by the prime minister of any asset abroad of dependent daughter, whereas Panama Papers confirms that Maryam Safdar was sole owner of two BVI companies and co-owner of one BVI company. She signed loan papers to secure funds against London properties.

The prime minister showed liability of Rs110,000,000 in respect of Ramzan Sugar Mills as on 30-6-2011. The total net worth declared was Rs149,398,035 (in 2010 net wealth was Rs63,737,827). Total expenses were shown at Rs19,878,706. No information is provided as to who was paying expenses of palatial Raiwind Palace (in papers it is shown as Shamim Farms in the name of mother who has no resources to bear its expenses).

Wife and daughter were shown as dependents in 2011 but assets of daughter were not shown as dependent as done in 2012.

The following details are available for tax year 2011:

Income: Rs10,200,000

Exempt agriculture income: Rs5,075,000

Other income: Rs141,423,354

Bank Profit: Rs97,755

Gift from son: Rs129,836,905

Personal expenses: Rs19,878,706

Gift to daughter: Rs31,700,000

Gift to son (Husain): Rs19,459,440

First Lady in 2012 declared income of Rs2136 only as profit from a bank account. She gave loan of Rs1,650,000 to mother-in-law and Rs1,100,000 to one Mr. Farooq Barkat. She has shown shares worth millions in four companies. In Chaudhry Sugar Mills, her holding was shown at 506,147 shares (worth Rs5,126,720). She received no dividend from any company! She also showed liability of Rs500,000 as business capital overdrawn in the name of her younger daughter (Asma Ali Dar). No business connection is shown by the prime minister though spouse has shown the same.

Both in tax year 2011 and 2012, the prime minister showed salary income from Chaudhry Sugar Mills in which he has 2,012,538 shares worth Rs16,000,000. He virtually controls this entity in which loan was received from an offshore company as per statement of Governor State Bank. It proves direct link of the prime minister with offshore companies.

The late father of the prime minister was owner of London property as per order of Queen Bench, London in the case of recovery of loan from Hudabiya Mills by Al-Towfeek Investment Bank. On his death, shares of Hudabiya Paper Mills were inherited by the prime minister but the property was not!

The prime minister is under moral and legal obligation to clear the names of his children. Before any commission of inquiry, nobody can provide information that is in exclusive possession of the prime minister and his family. They alone can bring the truth on record to clear their names. The prime minister should come on the floor of the House and place on record the following information:-

The dates of formation/purchase of all offshore companies in the name of any family member

1. How many bank accounts were opened outside Pakistan and sources of deposits

2. The names of owners/trustees of all offshore companies

3. Amount of money invested in these companies till to date and source(s) of initial and subsequent investments/transfers

4. Loans/advances obtained through these companies and what securities obtained by the financial institutions

5. All businesses abroad and amounts transferred from offshore companies to such businesses and vice versa

Income tax declarations of all family members filed at home or abroad

The replies to above questions should not be sidetracked by the government or opposition on the pretext of investigation through judicial commission or inquiry committee or task force. Nobody has so far raised the point as to why Nawaz Sharif did not declare assets/liabilities of Maryam Safdar though claimed to be dependent in declarations filed before the Election Commission in 2013.

Maryam Safdar became the sole shareholder of Nescoll in 2006 and letter to this effect was filed with Mossack Fonseca. She was also co-owner in a another BVI company, Coomber Group, through which in June 2007 loan of £3.5m was secured from Deutsche Bank. By not disclosing interests/assets/loans in offshore companies of Maryam Safdar, Nawaz Sharif in 2013 apparently violated section 12(2)(c)&(d) of Representation of People Act, 1976.

The Opposition, instead of wasting time at streets and creating commotion, chaos and demanding judicial inquiry, must invoke Article 62/63 of the Constitution and/or Representation of People Act, 1976. For misdeclarations(s) by public officeholder, disqualification is warranted by law, but it appears even the Opposition is not serious about it and wants to only capitalise politically on the situation arising out of Panama Papers. The society, as a whole, is showing apathy with pessimism about purging the system of corruption. People say accountability is a farce in our political culture.