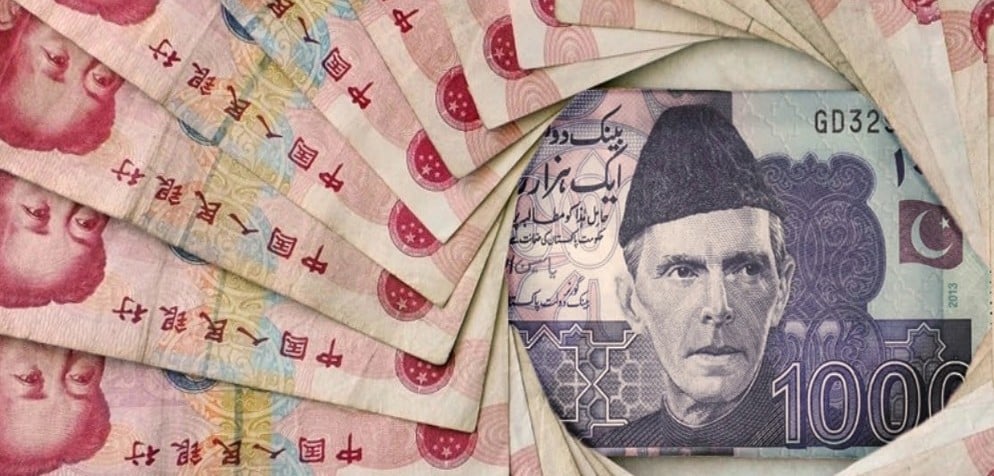

China is emerging as a hegemonic politico-economic power, with the yuan ruling the monetary roost

While the age of Dar(kness) has come to an end in our economy of misfortune, that of a home-baked professor of everything has begun. From planning, development and economic reform to interior, finance and foreign policy, this professor has a vision for everything. From 2010 to 2025, he has come a long way. 2047 is already within his sight. While the country has long forgotten about the five year plans, he has quietly completed the 11th five year plan and is already working on the 12th five year plan. Perhaps China and CPEC may have taught him to think long term, but he seems to have no patience for the minutest detail that the Chinese practice scrupulously in their planning. The latest example is his statement on the use of Chinese currency, yuan.

In December last year, he talked of a Chinese proposal to use yuan, not the US dollar, for payments in bilateral trade. The matter had come under discussion earlier in November at the meeting to finalise CPEC’s Long Term Plan. Press reports suggest China wanted yuan as legal tender in Gwadar. There is some confusion here, with the Planning Secretary indicating rejection and the professor keeping it under consideration. There is no knowing what the Chinese exactly said.

Enters State Bank of Pakistan (SBP), the real custodian of the rupee, to remind all concerned that the arrangements to use yuan in the Pak-China trade already exist, just as they do in the case of some other currencies. It is, however, the choice of the trader to prefer yuan to the dollar. The trader’s choice of currency depends on the ease of doing business in that currency.

Following CPEC, the intensification of the trade and commerce has begun to create the financial architecture necessary to facilitate the increasing use of yuan. As a matter of fact, a Currency Swap Agreement was signed with People’s Bank of China (PBC) as long ago as in 2012.The PBC now has expanded into avenues beyond cross-border trade, mainly to facilitate investments and other financial transactions related to CPEC, all in keeping with the SBP rulebook.

There should be no doubt that the yuan has to occupy its rightful place in the global marketplace in proportion to the mammoth size of its economy. Towards the end of 2015, the yuan met the IMF test of free usability. It is now not only a recognized currency to form part of the foreign exchange reserves, but is also in the prestigious basket of currencies comprising the SDRs (Special Drawing Rights). So the international accreditation is already there. But the actual footprints depend on the demand for yuan by the national economies. It does not have to be a legal tender, dear professor.

Money is anything that is mutually acceptable in exchange and generalises purchasing power. As the One Belt One Road connects national economies, so will yuan. Pakistan and CPEC are no exception. It seems the world is readier to embrace yuan than China herself. A Hong-Kongization of China to allow freer inflows and ouflows of money will be necessary for the development of the bond market. So far China has been somewhat immune to international crises. Liberalisation of the capital account will entail that risk. China will thus take time to move in this direction, just as it avoided jumping into the free market like Russia to prevent a free fall.

For now, China is focusing on yuan-denominated pricing of major commodities like oil. Soon one would see oil futures trading in yuan. Her chief central banker has been meeting the Saudi counterparts, raising the prospects of petro-yuans.

The traditional view of the rise and fall of the great powers is that the rising power dominates in three strategic dimensions -- political, economic, and monetary. The story of the fall of the pound sterling and the rise of the dollar is told in these very terms. This same approach is being applied to predict the emergence of China as a hegemonic politico-economic power, with the yuan ruling the monetary roost. What economists call network effects not only cause the emergence of this hegemon but also its persistence.

In a recently published book, How Global Currencies Work: Past, Present, and Future, by Arnaud Mehl, Barry Eichengreen, and Livia Chitu, the traditional view has been challenged as a historical and narrowly economistic. It argues that multiple currencies can coexist. Indeed they did in the past, as they do right now. Three international currencies existed before the First World War. In the interwar period, the Great Depression was blamed on the continued dependence on the pound sterling despite the declining ability of the British imperialism to ensure a stable international financial system. According to the authors, "If international currency status is not a natural monopoly in which strongly increasing returns produce lock-in, then other countries need not depend exclusively for their liquidity needs on a relatively mature, slowly growing economy in relative decline." This will also lead to the co-sharing of the "exorbitant privilege" of lower cost of issuing debt and the end of automatic insurance enjoyed by the leading currency witnessed during the international financial crisis, despite being the original sinner.

China does not need yuan to be legal tender in Gwadar to expand its international role. In Badaber, a US base near Peshawar in the cold war days, the dollar was used as a medium of exchange without being declared legal tender. Something similar could happen in Gwadar. What is more relevant is that China is now Pakistan’s largest trading partner. It is only natural that the currency composition of Pakistan’s trade changes accordingly.

The use of yuan will also have to increase as China is all set to become our biggest creditor as well. It is time that the SBP gears up for a multi-currency world. As for the professor, here is the advice from Oscar Wilde: "Cecily, you will read your Political Economy in my absence. The chapter on the ‘Fall of the Rupee’ you may omit. It is somewhat too sensational. Even these metallic problems have their melodramatic side." -- Miss Prism in The Importance of Being Earnest.