The present government’s strategy of more oppressive taxes has not only failed to bridge the fiscal deficit but has also retarded economic growth

For the last many years, analysts have been emphasising that our economic managers should, instead of imposing regressive taxes to meet fiscal deficit, concentrate on structural reforms to achieve sustainable minimum 7 per cent to 8 per cent economic growth for at least a decade, increase exports and investments, create more jobs, improve infrastructure, overcome power shortage and restructure loss-making public enterprises. Unfortunately, the strategy of the present government, like the earlier ones, remains focussed on austerity and more oppressive taxes. These measures have not only failed to bridge the fiscal deficit but have also retarded economic growth.

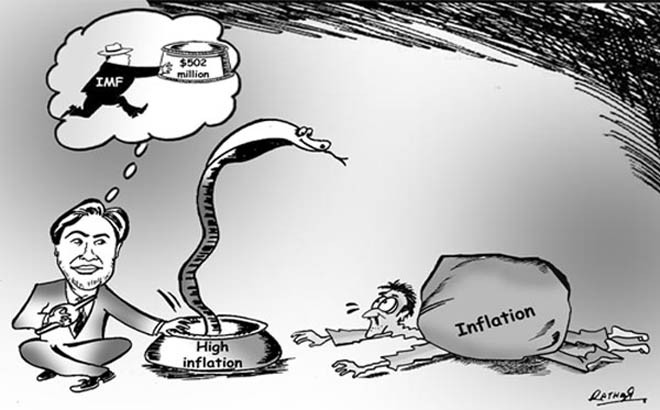

On August 7, 2015, the International Monetary Fund (IMF) at the conclusion of eighth review of the $6.2 billion Extended Fund Facility agreed to waive requirements of budget deficit and borrowings from the State Bank of Pakistan (SBP). Pakistan has already received $4.2 billion under the programme and does not want bi-annual reviews to disturb the cash flow plan of the remaining $2 billion. Currently, the IMF plans to release this amount in four quarterly tranches of $500 million. The IMF has stressed the government to carry out much-delayed reforms in all spheres that include complete overhauling of Federal Board of Revenue (FBR).

Even at the beginning of fiscal year 2014-15, the IMF was aware that Pakistan would not to achieve revenue target of Rs2810 billion and restrict fiscal deficit to 4.9 per cent of GDP -- revenue collection was short by Rs222 billion and fiscal deficit was widened to 5.3 per cent of GDP. Finance Minister Ishaq Dar, as usual, tried to shift the blame onto the provinces claiming that "they could not ensure promised cash surpluses of Rs287 billion." The reality is that it was due to the failure of FBR that missed the original target by a great margin and failure to check unproductive expenses.

Independent economists claim that fiscal deficit was around 8 per cent and growth rate remained stagnant at around 3 per cent to 3.5 per cent since 2008. They allege that international institutions are not speaking the truth about the Pakistan economy.

Noted economist Dr Ashfaque Khan contested the figures presented by the finance minister and endorsed by the IMF. He was surprised at treating "inflows from Habib Bank Limited as non-tax revenue (under the head of State Bank of Pakistan profit) instead of privatisation proceeds to show a better revenue collection target than is in fact the case". He also contested the view of the IMF Mission Chief, Harold Finger, that "pro-growth strategy was possible without fiscal stimulus." He said that economic activity was a pre-requisite for growth and "it cannot be achieved by reducing the budget deficit."

Another known economist, Sakib Sherani, accused the IMF of endorsing the Finance Ministry’s "false statements of achieving stabilisation instead of bringing forth the reality of the on-ground economic situation of the country". He said that "stability is not likely to be achieved through increased borrowing, slashing development spending, without raising tax to GDP ratio and not addressing structural issues of the economy." The present government, he said, came into power with high expectations premised on tall claims of an experienced team that would bring about quick reforms in governance and fix structural issues in the economy to benefit the people. However, the team has proved itself either incompetent or lacking in political will during the last two years, Sakib added.

In his article, Rejoinder to the IMF, Dr Hafiz Pasha, Managing Director of the Institute for Policy Reforms and former Federal Finance Minister, concluded that "since the growth strategy without the fiscal stimulus is not working, there is need to also look at other stimuli. Fortunately, interest rates have come down sharply, following the precipitous decline in the rate of inflation, and there is scope now for also pursuing a more expansionary monetary policy. Further, an adjustment in the exchange rate has become essential if the process of export-led growth is to be initiated once again."

The main malady behind fiscal deficit remains unattended: non-payment of due taxes by our ruling classes. The rulers are not concerned with unemployment, trade, fiscal and current account deficits, rising cost of doing business, enhancing taxes, especially on petroleum products, increases in utility bills, economic stagnation and industrial slow down. They are either engaged in self-praise or fighting with the opposition. People’s purchasing power is rapidly diminishing, banks have lesser liquidity and the government has become a predator -- it takes away major deposits as banks are not at all interested in lending money to the private sector for growth-oriented and job-creating investments. Foreign investors are shy and afraid, mainly due to law and order situation, unprecedented corruption at all levels of governments, perpetuation of political instability and economic uncertainty.

Miseries of the common man are increasing with every passing day, leading to social restlessness. The official experts keep on reminding us that Pakistan is basically an agrarian economy, but they never explain why a vast majority of the people do not have enough to eat. Why we have shortage of edible items? Why their prices are skyrocketing day by day. Why Chairperson of Competition Commission is not conducting investigation and taking action against cartels supplying expensive inputs to poor farmers?

It is tragic that being an agricultural economy, we import agricultural products (our import bill of edible oil runs into billions of dollars). We have utterly failed to develop any worthwhile agro-based industry since independence. What a decline from the times when this region (United Punjab before partition) had the undisputed position of being the granary of the entire Subcontinent!

Look at the mess created by our successive governments -- military and civilian alike -- on the debt front. According to State Bank of Pakistan as on March 31, 2015, the total foreign debt and liabilities stood at US$ 62.6 billion of which public debt is US$ 55 billion. The country’s total debt was Rs. 19.3 trillion. This figure was Rs9.7 trillion in 2013. In June 2008, the total debt was Rs6.1 trillion. The country paid $6.820 billion in debt servicing in FY15, including $5.910 billion towards principal amount and $915 million for interest payments.

Our governments have been hooked on reckless foreign and domestic borrowing instead of reducing the monstrous size of government machinery and replacing the extraordinary tax-free benefits, perks and perquisites to the militro-judicial-civil complex and public office holders with consolidated pay package.

While the problem of power shortage persists, avoidable imports continue unabated, rulers keep on indulging in wasteful expenditures, trade deficit remains worryingly high, decline in exports, and domestic industry remains both costly and uncompetitive. The grim reality of Pakistan is perpetuation of the unholy alliance of ruling classes poised against the masses. All the governments, including the present one, never seem concerned with the welfare of masses but appear more keen to leave concrete monuments, defacing historical cities only to gain cheap popularity.