The PML-N government’s focus should be on reducing income inequalities and turning growth more inclusive

The budget debate in the National Assembly is over with finance minister accepting 56 out of 92 suggestions coming from the Senate in totality and 20 partially. Treasury benches in the parliament claim that the budget is pro-poor and people-friendly, just as the opposition benches find this budgets anti-people and anti-poor. Interestingly, most of these claims are made without even going through the finance bill documents. So, how to determine whether a particular budget was pro-people or anti people.

In good old days, federal budget was important for the general masses as prices of essential commodities which matter to them, such as gasoline, kerosene oil, diesel, gas, and electricity, sugar, and cooking oil etc., were often announced in the budget. However, currently, it is just the guesstimate of grossly understated expenses and hugely overstated revenues presented in a manner to remain within the fiscal deficit target agreed with the IMF.

Prices of energy are determined, almost on a monthly basis, by the "independent" regulatory bodies, such as OGRA and NEPRA. Prices of other essential commodities are determined by "market forces" which are free to act in any manner that suits them.

What else in the finance bill can affect the masses? The extent of indirect taxation (i.e., custom duties, sales tax, federal excise duty) and other taxes (i.e., Gas Infrastructure Development Cess, Natural Gas Development Surcharge, and Petroleum Levy etc.) also affect the masses. In the outgoing fiscal year, the FBR is aiming to collect Rs1496 billion as indirect taxes, whereas during next fiscal year it is supposed to collect Rs1755.83 billion as indirect taxes.

Thus, people irrespective of their income, would have to pay additional Rs260 billion as indirect taxes. Indirect taxes are always regressive in nature and often hit people falling in low income bracket. Although one per cent lower than outgoing year, indirect taxes still make 56 per cent of the total FBR revenue. If the federal government achieves its revenue targets for the next fiscal year, then it would be left with Rs2463 billion after paying the share of the provinces (under NFC and direct transfers, etc.).

Against an income of 2463 billion rupees, the federal government has planned to spend Rs4089 billion. Thus, there would be a deficit of Rs1625 billion or 40 per cent of net federal revenue (5.29 per cent of GDP). However, it exceeds the sacred figure of 4.3 per cent of GDP (Rs1328 billion), the upper limit of fiscal deficit negotiated with the IMF. The federal government has planned to meet 4.3 per cent deficit through external and domestic financing. Whereas left over 0.99 per cent would be met through an estimated provincial surplus (unspent money by provinces which is left with federal government. Provinces earn markup on such deposit; an incentive for them not to spend).

Out of the planned Rs4089 billion total federal expenditures, a huge chunk 77.42 per cent is current expenditures. Current expenditures budgeted as Rs3166 billion are already more than the total federal revenue (Rs2463 billion), which means the federal government would have to borrow to meet these expenditures. The same would happen for development expenditures (Federal PSDP) which are planned to be 17.11 per cent of total federal expenditures.

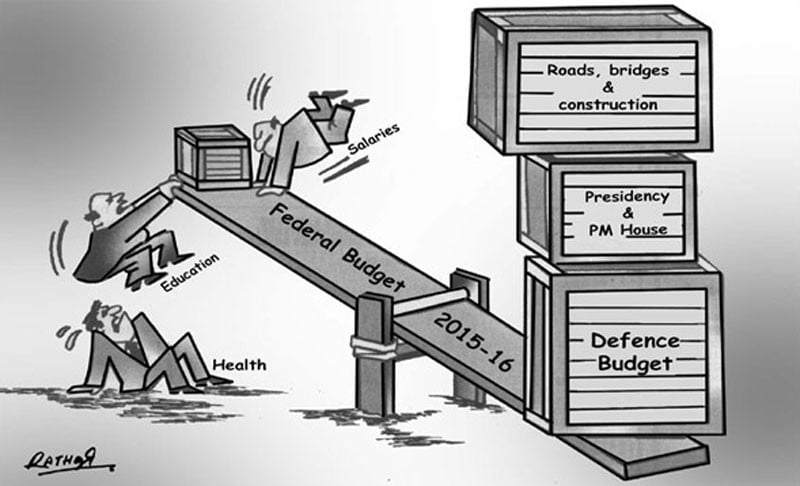

Current expenditures (CE) are often non-discretionary, which cannot be compromised. Markup payment makes 36.75 per cent of CE, include foreign loan repayments too and this figure shoots up to 45.84 per cent. These payments are non-discretionary and cannot be compromised. Defence affairs and Services are 23 per cent of CE, add 4 per cent of military pensions to it and the figure would be 27 per cent of CE.

This expenditure head is again non-negotiable due to our peculiar security needs. Foreign loan repayments, markup repayments and defnece makes up 73 per cent of our CE. Then comes running of civil government which including the civil pensions is 10 per cent of CE. The proportionate allocation to these three heads reflects our priorities and quality of governance that one should expect in this country.

Now let us come to public sector development programme (PSDP). PSDP is lubricant of growth. It has to respond to the diagnostic report on state of economy which is presented through Economic Survey of Pakistan (ESP) before the budget every year. This years’ ESP tell us that growth in both agriculture as well as industrial sector is going down. The share of services sector in GDP is the highest, and none of the three sectors could meet their growth targets thus affecting the overall GDP growth target.

Services sector is contributing to 58.8 per cent of GDP and absorbs highly skilled or highly literate human resources. Whereas agriculture sector whose contribution to GDP has declined to 20.9 per cent is still absorbing almost half of the workforce: mostly semiskilled and illiterate.

So what should be the priority in the PSDP? Job creation for which we require a two-pronged strategy. First to improve the education and skills sets of our labour force radically enabling more people to get absorbed in services sector. Second to invest in agriculture and industry enabling these two sectors to grow at a fast pace and absorb the existing human resources.

What are the existing priorities in federal PSDP? Maximum allocation of Rs159.6 billion for National Highway Authority (roads); Rs112 billion for WAPDA (Power); Rs100 billion for TDPs and security enhancement (security TDP resettlement); Rs30 billion for water sector; and Rs20.5 billion for HEC (Higher Education), while the rest of the things are small ticket items. It is not the question of either-or. We require good roads, electricity, mass transit system, security, quality education for all, drinking water, sanitation, food security and lot more.

Certainly, these allocations are not enough to address the systemic problems of Pakistan’s economy. But then one needs to be realistic and should not forget that PSDP would be financed through borrowed money and part of what we are borrowing would be used to payback the existing debts. It is the same old story which has been getting repeated for last many decades now.

The bad news is that there is nothing new in the federal budget 2015-16. Like previous budgets, it would inflict some pain on the people living below poverty line, not because it is pro-poor, but due to the fact that unfortunately that segment of our society has nothing left to loose. It will inflict very little pain on the upper class as most of the measures proposed in it are regressive in nature.

However, it would massively hurt the white collared lower middle income and middle income class of our society. This would result in increased inequality and income disparity between the haves and have-nots. One of the results of such segregation is increased class conflict, frustration, and violence in the society.

The good news is that, due to many external factors (reduction in oil prices, Saudi gift, 3-G auction money etc.) and partly because of the borrowed money, we have got comparative macro-economic stability. This may be used as launching pad to spur growth. However, mere growth strategy is not enough.

We require a total different strategy to mitigate the bad news discussed in previous paragraphs. The PML-N’s focus should be on reducing income inequalities and turning growth more inclusive rather than mere growth. In other words they need to think of how the benefits of macro-economic stability would be distributed at micro level.