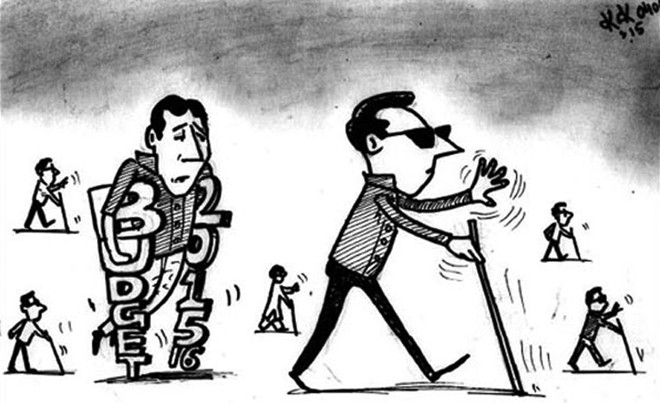

The existing tax policy, which is stifling economic growth and widening the rich-poor divide, needs to be reformulated

The dilemma of our economic managers, especially the honourable finance minister, is that they are painting a rosy picture of economy in utter disregard of the fact that growth is slow, exports are declining, power shortages persist, debts are increasing, fiscal deficit is widening, poverty is a reality for millions, tax compliance is extremely poor and unemployment is a source of disillusionment for the overwhelming young population. We need sustainable eight per cent growth rate for a decade to provide two million jobs every year to our youth alone.

According to economist Dr Akmal Hussain "economic growth has not been sustainable because of a set of structural constraints, the most important of which are: (i) A narrow base for savings which makes the savings rate (less than 12 per cent of GDP) half that of the investment rate (24 per cent of GDP) required to sustain a GDP growth rate of 6 per cent. (ii) A narrow base for exports which excludes potential small scale high value added export based industries and instead concentrates on a small number of large scale textile units at the low value added end of the textile range and therefore export growth is insufficient to finance the foreign exchange requirements of a high GDP growth trajectory."

Our elite based growth process, argues Dr Akmal, has witnessed accelerations only in spurts "during periods when foreign aid is provided to fill both the savings and foreign exchange gaps." His most valuable conclusion is that "an extremely unequal distribution of productive assets in both manufacturing and agriculture has resulted in growing income inequality during the high growth periods, thereby severely constraining the capacity of growth for poverty reduction."

Here comes the role of tax policy that can ensure distributive justice. Economic justice is an important function of tax policy as it relates mainly to distribution of tax burden and benefits of public expenditure. It is a component of the broader concept of social justice, which encompasses, besides distributive justice, such questions as treatment of less privileged sections, empowerment of women, protection of children, and many other areas like racial, lingual, religious tolerance in a society.

Tax policy is a democratic method to influence the distribution of income and wealth on desired lines. The main ingredients of this policy can be (a) progressive direct taxation of income, wealth, and property transactions, (b) taxation of commodities (customs duty, excise levy, and sales tax) purchased largely by high-income groups, and (c) subsidies (negative taxation) on goods purchased by low-income groups. Unfortunately, since 1977, Pakistan has been moving from progressive taxation to regressive taxation. Regressive taxation is a self-destructive path that paves the way to civil commotions, especially in societies of countries like Pakistan that are divided on economic, geographical, lingual and ethnic lines.

The existing tax system protects the rich and heavily taxes the poor. This cruel taxation is meant to finance the luxuries of militro-judicial-civil-political complex. The mighty sections of society not only enjoy tax-free benefits but also get state lands at throwaway prices or as free awards. The government is least bothered to tax undocumented economy and benami transactions. Since, the mighty sections of society are engaged in these transactions, Federal Board of Revenue (FBR), being their handmaid, is helpless. It is evident from Tax Directory 2014 published on April 10, 2015 showing only 52,349 persons in the entire country admitting tax liability of more than Rs500,000!

It is an undeniable fact that in Pakistan massive sales tax evasion prevails coupled with non-reporting of income by the rich and mighty. For improving documentation and better collection of taxes, without hue and cry from any segment of society, a well-thought-out scheme is required that should not only check leakages in tax collection, but also incentivise the people to file their income tax and sales tax returns.

In the coming budget, the government may consider a scheme under which anybody who pays sales tax and gets a receipt should be entitled to claim refund of 20 per cent of the amount paid. The procedure for claiming refund should be simple i.e. payer of tax should send invoices to Central Tax & Refund Depository, which authorises refund from the nearest branch of National Bank, after verification of genuineness of the invoice (by checking sellers’ registration number). In this way, the FBR can develop data base about sales and then register those who are outside the tax net, as well as do fair assessment of existing ones.

People may be afraid to claim full credit of sales tax paid by them since they would not be able to justify sources of their expenses. To overcome this, the government can announce immunity from scrutiny of their expenses declared through sales tax invoices alone for a couple of years -- this short term step would go a long way to document the economy yielding more and more revenue in the coming years.

The role of FBR should be restricted to revenue collection alone. For devising tax policy, a permanent board having representation of federal government, provincial governments and public should be established in the Revenue Division. Economic Advisory Committees and Tax Reforms Commission should not only suggest improvements in the administrative structure and tax codes but present a comprehensive plan for revenue generation harnessing our real tax potential. One hopes these bodies and other experts for the coming budget will suggest workable initiatives inducing the citizens to discharge their obligations voluntarily and happily and money collected from them is spent for the well-being of all and not just for the luxuries of the privileged classes.

There is a national consensus that existing tax policy has been stifling economic growth and widening the rich-poor divide. It needs to be reformulated to provide an equitable, pragmatic and investment-oriented environment, integrating efficient tax administration with simplified tax laws that are easily comprehensible and hassle-free from implementation perspectives.

In his budget speech last year, the finance minister set the GDP growth rate target at 5.1 per cent, inflation at 8 per cent and tax-to-GDP ratio at 11.5 per cent. As we are close to the end of the current fiscal year, State Bank of Pakistan forecasts 4.3 per cent GDP growth rate, while the IMF estimates it at 4.1 per cent. None of these institutions are concerned with equitable growth and institutional reforms as emphasised by Dr Akmal and others. It is, therefore, highly unlikely that in the forthcoming budget, to be announced on June 5, 2015, the government would launch programmes, financed mainly through taxing the rich, to solve the twin problems of unemployment and poverty.

Taxation should be for providing subsidised/free medical and educational facilities, low-cost housing, and drinking water facilities in rural areas, land improvement schemes, and employment guarantee programmes. However, our rulers in every budget resort to more harsh tax measures that can never promote tax compliance and economic justice. The government must remember that excessive and unjust taxation prevent individuals and businesses from taking full advantage of the opportunities of the new knowledge-based economies.

Taxpayers (including businesses) should share the burden of protecting those who are vulnerable as a result of change, either through well-designed social protection measures or re-training, not through excessively rigid job protection measures and inflexible labour regimes that penalise productivity. That is why a fair and transparent tax system is so essential for maximising economic growth.

Politicians must have the courage to achieve a sensible balance between income, capital and consumption taxes. And they must also have the courage to spend, not on ill-designed programmes introduced more to collect votes than social returns, but on important investments in creating human capital (e.g. education, training and health), and necessary public infrastructure to increase productivity of the economy.