Achieving fiscal targets seems impossible unless massive sales tax evasion is stopped

The Federal Board of Revenue (FBR) is taking pride in 12.2 per cent growth in collection during the first nine months of the current fiscal year. It has collected Rs1766.819 billion from July 2014 to March 2015 as compared to Rs1574.698 billion in the corresponding period of last year.

It is pertinent to mention that the target of FBR has already been reduced from Rs2810 billion to Rs2691 billion. For showing "higher" (sic) figures, the government in February this year imposed 10 per cent regulatory duty on 314 items and increased general sales tax on petroleum products to 27 per cent from 22 per cent. For achieving the revised target, the FBR needs to collect Rs924 billion in three months, which appears to be an uphill task.

This year the FBR has paid 4.5 per cent less refunds as compared to last year -- in nine months total amount is Rs77.812 billion as against Rs81.494 billion last year. According to experts, total collection may reach Rs2500-2600 billion if growth of 15 per cent is maintained. Bifurcation of figures shows collection of direct taxes at Rs693.2 billion compared to Rs598.829 billion last year (increase of 15.8 per cent). This includes blocked refunds as well as advances that are yet not due, of nearly Rs50 billion, if not more. If these are excluded, growth will be negligible.

Sales tax collection showed growth of just 6 per cent -- Rs791.949 billion collected as compared to Rs716.793 billion. Customs showed growth of 23.4 per cent due to increase in imports that otherwise eroded foreign exchange reserves nullifying this growth.

Federal excise duty also showed meagre increase of 6.2 per cent. In sales tax/excise refunds due are over Rs100 billion -- thus in real terms growth is not at all 12 per cent as wrongly projected by the FBR by concealing the payable liabilities.

Since the FBR has failed to raise the number of tax filers and levy tax on the rich according to their real income, there is no hope to achieve even the revised target. The average growth of 12 to 14 per cent during the last ten years is not a feat but a failure especially when the real tax potential of the country is not less than Rs8 trillion and refunds due are not paid. We have highlighted in these columns repeatedly how this negligible growth has been achieved by shifting burden of taxes on the poor by relying more and more on indirect taxes, even in the garb of income tax.

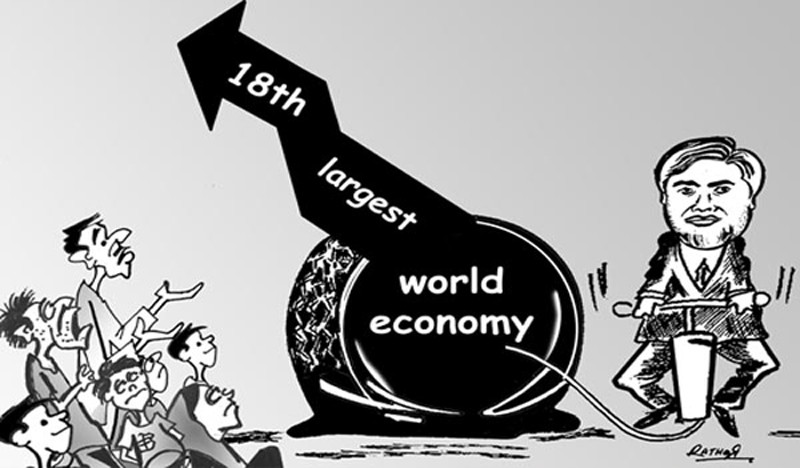

The FBR after wasting billions in the name of reforms has failed to improve tax-to-GDP ratio -- it has in fact declined from 12.5 per cent in 1993-94 to 9.5 per cent in 2014-15. This is even after imposing all kinds of regressive taxes, blocking genuine refunds, raising fictitious demands and fudging figures by taking credit of next year’s advance tax in the current year.

For achieving real tax potential of Rs8 trillion and raising tax-to-GDP ratio, Pakistan needs to make radical changes like reduction of exorbitant sales tax rate, expanding tax base and introduce simpler and fairer tax procedures to encourage investments and savings. The government needs to re-prioritise its tax goals while finalising budget for fiscal year 2015-16 to attain better tax compliance and collection, along with rapid industrial and business growth.

It is undeniable fact that there prevails massive sales tax evasion coupled with non-reporting of income in Pakistan. The government must tackle the issue by giving benefits/incentives. For improving documentation and better collection of taxes, without hue and cry from any segment of society, a well-planned scheme is required that should not only check leakages in tax collection, but also incentivise the people to file their income tax and sales tax returns. The goal of expanding tax base and combating tax evasion should be tackled skilfully.

In the coming budget, the government may consider a scheme under which anybody who pays sales tax should be entitled to claim refund of 20 per cent of the amount paid. The procedure for claiming refund should be simple i.e. payer of tax should send invoices to Central Tax and Refund Depository, which authorises refund from the nearest branch of National Bank, after verification of genuineness of the invoice (by checking sellers’ registration number). In this way the FBR can develop data base about sales and then register all the sellers. It would help in cross verification of sales declared by them in their sales/income tax returns. The people may be afraid to claim full credit of sales tax paid by them since they could not justify sources of their expenses. To overcome this, the government can announce immunity from scrutiny of their expenses declared through sales tax invoices alone -- it will go a long way to document the economy yielding more and more revenues in the coming years.

This scheme will encourage people to obtain sales tax invoice for each transaction, which is presently not being insisted upon. Evasion of sales tax is mutually beneficial. If sales tax payers are given the above incentive, they will insist on sales tax invoice and the government, without expending any money or making extra efforts will be able to expand tax net. Such schemes were successfully implemented in Taiwan, Turkey and Venezuela.

The FBR at present is not performing its prime duty of collecting revenue. It remains busy in constituting committees for preparing tax policy and changes in laws. These are the domains of the government and Parliament. The FBR seems more eager to do the job of legislators. For many years, advisory committees have existed and now even Tax Reforms Commission has been established for suggesting improvements in the administrative structure and tax codes. As in the past, we will merely have repetition of old proposals dressed in news words. Nobody is willing to go for an all-out reform for which a comprehensive plan was given in these columns.

The bureaucrats -- both sitting and retired -- suffer from the all-knowing syndrome. They are, in fact, responsible for the present pathetic state of affairs. They being defenders of status quo can never bring positive, pro-business and people-friendly changes in the oppressive tax system. They thrive on this rotten system and want to exert complete control through complicated laws and cumbersome procedures -- nowhere in the world delegated powers to an executive authority are available to undo law passed by parliament through a Statutory Regulatory Order (SRO) -- this notorious practice should be abolished straight away.

The need of the hour is low-rate (5 per cent to 7 per cent) across the board sales tax coupled with speeding up tax refund payment to the business community. The system should be fair and transparent and its enforcement must be strict and stringent -- there should be no sacred cows. Tax base cannot be broadened unless all the goods and services -- barring a few essential eatables, books, children’s garments, educational tools etc. -- are brought into the net of sales tax and all persons having income of Rs500,000 or more are taxed and forced to file returns with declaration of assets and liabilities. If they refuse to do so they should be barred from opening bank accounts and transact any business or seek employment.

The government must remember that excessive and unbalanced taxation can prevent many individuals and businesses from taking full advantage of the opportunities of the new knowledge-based economies. Taxpayers (including businesses) should share the burden of protecting those who are vulnerable as a result of change, either through well-designed social protection measures or retraining, not through excessively rigid job protection measures and inflexible labour regimes that penalise productivity. That is why a fair and transparent tax system is so essential for maximising economic growth.

Politicians must have the courage to achieve a sensible balance between income, capital and consumption taxes. And they must also have the courage to spend, not on ill-designed programmes introduced more to collect votes than social returns, but on important investments in creating human capital (e.g. education, training and health), and necessary public infrastructure to increase productivity of the economy.