Bazar’s shutter-down threats always force tax administrators to succumb to traders’ demands on the behest of political masters

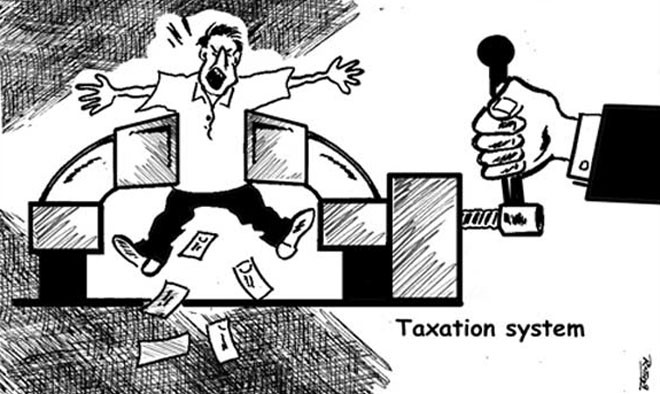

Since 1980s, amongst many segments of society, the one that really created hassle for the tax departments (both federal and provincial), is that of unscrupulous traders. Though their contribution in total tax revenue is negligible (0.5 per cent in income tax and 1 per cent in sales tax), they exert substantial influence over politics.

As a strong lobby with money and shutter power, they finance politicians and bribe the state functionaries. They successfully counter any form of legislation aimed at equitable taxation, dubbing it as ‘anti-business’. In this way, they successfully avoid progressive taxation and manage to accumulate wealth. On attaining power, they indulge in rent-seeking rendering government machinery ineffective. They promote cronyism and culture of sycophancy. Plato’s quote in Republic that "ruin comes when the trader, whose heart is lifted up by wealth, becomes ruler" aptly applies to present day Pakistan.

History of tax laws in Pakistan is fraught with frequent amendments under pressure from Bazar’s shutter-down threats or demonstrations, forcing tax administrators to succumb to their demands on the behest of political masters. A cursory look at various statutory regulatory orders (SROs) confirms this point.

It is a well-established fact that traders have always been quick to avail any type of amnesty scheme to whiten their ill-gotten wealth/undeclared incomes. Thus, whether these are Self-Assessment Schemes, Special National Fund Bonds or Simplified Fixed Tax Scheme, Foreign Currency Accounts or Foreign Exchange Bearer Certificates, or the infamous section 111(4) of the present Income Tax Ordinance, 2001, at the forefront are all traders, who defy tax laws with impunity and support politicians financially.

Continuous failure of Federal Board of Revenue (FBR) in meeting even the lowest possible revised targets during the last many years must be seen in the background of policy of appeasement of the successive governments towards tax evaders. Figures relating to income tax/sales tax filers prove this--less than 1 per cent of total population discharges its tax obligation. This is despite the fact that on becoming prime minister for the third time, Nawaz Sharif in November 2013 announced a generous one-time tax amnesty scheme vide SRO 1065(I)/2013.

Premier Nawaz Sharif personally announced what he called "a package for promoting tax culture, investment in industry and the incentive package for revival of economy." The scheme included immunity from audit, default surcharge and penalty for NTN holders who did not file some or all income tax returns for the last five years "provided they file their missing income tax returns and pay a minimum of Rs 20,000 tax per year."

Similar immunity from audit, default surcharge and penalty was extended to non-NTN holders having taxable income, provided they paid tax at a minimum of Rs 25,000 per year, and filed returns for the last five years. Such return filers were assured of immunity from audit also for equal number of subsequent tax years for which they would file returns.

The audit of thousands of cases was suspended after the prime minister’s relief package (sic) to save known tax dodgers. This was done despite giving commitment to the IMF that no further tax concessions would be given, especially through SROs. The finance minister violated this promise. He used the infamous tool of SROs to nullify all measures for documentation of the economy announced in the budget 2013-14.

The law passed by the Parliament requiring banks to share transactions exceeding one million was suspended in the case of ‘existing taxpayers’ through SRO 115(1)/2014 dated 19-2-2014 allowing them to keep on evading taxes by just paying small amounts. Resultantly, the FBR only collected Rs 2254.5 billion in 2013-14 against the original target of Rs 2475 billion--a huge shortfall of Rs 220.5 billion.

Surrendering to influential lobbies of businessmen after the announcement of the budget is the main reason behind the shortfall in revenues. Since assuming power in June 2013, the government has failed to collect taxes due from the business community.

The FBR chairman is on record admitting that because of exemptions and concessions given through SROs almost two-thirds of imports are duty free. If only such SROs, which are nothing but favours to certain business houses, are revoked, the collection of the FBR can easily be doubled. If leakages like under-invoicing, flying-invoices, fake refunds etc are effectively countered, the FBR can easily triple its revenues.

Tragically, in the face of this situation our worthy finance minister claims "the economy is going in the right direction". The reality is that two-thirds of tax money is being stolen right under his very nose.

The FBR chairman keeps on complaining that due to extraordinary concessions and amnesties, his team cannot collect taxes on optimal level. The worthy finance minister, however, remains busy in self-praise claiming wonders have been achieved. It is an incontrovertible fact that enormous tax exemptions and concessions coupled with non-observance of tax laws by mighty traders has eroded Pakistan’s tax base. Less than 15,000 individuals filed tax returns in 2014 showing tax liability of more than one million whereas from 1,500,000 ultra-rich Pakistanis, income tax of Rs 500 billion should be collected.

Our worthy prime minister by personally announcing unprecedented tax concessions for the dodgy traders reconfirmed the track record of his party of appeasing tax cheats. In the wake of "Tax Relief Package", Ishaq Dar proudly pronounced: "25 out of 26 demands of traders have been accepted." The amnesty scheme, even after two months’ extension, failed miserably. Only a little over 3000 persons availed this scheme paying paltry amount of about Rs 100 million. Neither the premier nor the finance minister admitted the failure of this scheme, and instead blamed the FBR for not achieving targets.

At the very beginning of this scheme, experts emphatically opined that it would not succeed as people enjoyed much cheaper solution under section 111(4) of the Income Tax Ordinance, which they had been availing with the connivance of unscrupulous tax advisers and money exchange dealers. It is not understandable what is preventing the Parliament to delete this obnoxious provision of law. Section 111(4) of the Income Tax Ordinance, 2001 provides a free hand to people to whiten their untaxed incomes and undisclosed assets. Presence of this law proves that our legislators protect and sanctify both tax evasion and money laundering.

This despicable provision of law guarantees unscrupulous elements of complete protection regarding source of their ill-gotten, un-taxed money. No question can be asked by the tax authorities if tax evaders remit dirty money from outside through banking channels and surrender the foreign exchange to the State Bank. The modus operandi is simple: go to a money exchange dealer and for small premium he will arrange ‘remittance’ (sic) for you. It promotes hundi/hawala business which is in full swing in Pakistan. Disastrous ill-effects of this law are tax evasion and financing of terrorism. Even then those who matter in the land are not ready to revoke it giving rise to apprehensions that they are a party in this dirty game.

The stark reality of Pakistan is that the rich remain outside the tax net, while the poor are paying 17 to 22 per cent GST on commodities of daily use. When tax was imposed on salt in the colonial era, the visionary leaders of that time staged a revolt against such high-handedness. But in the post-independence period, our rulers are playing havoc with the life of the common people by levying exorbitant tax on many everyday items. It is tragic that neither the media nor non-governmental organisations have raised a strong voice against this injustice.

In Pakistan, huge business empires through money power influence elections--politicians get generous funds from them and after assuming power, pay them back by introducing tax amnesties and concessions through SROs. Together they make billions through rent-seeking, tax evasion, and remit this ill-gotten wealth abroad.

It is high time that after publishing tax directory of all those who filed tax returns, the FBR publish another directory of tax defaulters, revealing the names of wealthy property owners, affluent lawyers, doctors and other professionals, politicians, businessmen, judges, generals, high-ranking officials and their dependents who own assets worth billions of rupees but either do not file tax returns or cannot justify luxurious life and accumulation of wealth from their declared incomes.