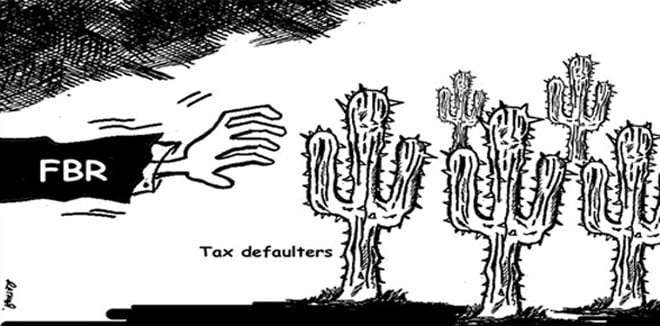

The right to taxation or exemption is exclusive domain of the Parliament and Executive (FBR) should only implement the laws and refrain from legislation

In tax laws, many statutory regulatory orders (SROs) create discriminations among people equally placed, favour the influential segments of society and open avenues of corruption. Through SROs, the Federal Board of Revenue (FBR) provides "legal" ways and means to mighty sections of the society to amass huge wealth. Exemptions and concessions given through SROs were of Rs5500 billion in the last five years alone as admitted by the Chairman FBR before the Senate Standing Committee on Finance & Revenue on May 13, 2014.

The most glaring example of abuse of issuing SROs surfaced when before presenting the Finance Bill, 2013, the FBR issued many beneficial notifications for the benefit of new rulers, especially for sugar and steel industry. In 2012, when officers of grade 19-22 were allowed monetized transport allowance, SRO 569(I)/2012 was issued on 26 May 2012 providing that government officials in grade 20-22 would pay just 5 per cent tax on this allowance as a separate block of income.

In Finance Act 2013, the flying allowance of PIA pilots was clubbed with salary in case of allowance exceeding basic salary. The Finance Minister did not provide similar treatment for mighty bureaucrats for their transport allowance. This shows how elites get extraordinary tax benefits through SROs and public is overburdened with enormous indirect taxes.

Take another example of commercial importers of polyester filament yarn, a basic raw material for the domestic fabric industry. They are subjected to pay additional value-added tax of two per cent and withholding income tax at six per cent. It makes their cost of import higher than that of the industrial importer, which is subject to the value-added tax at zero per cent and withholding income tax of one per cent only. This provides an avenue of corruption to unscrupulous commercial importers to import the raw materials under the guise of manufacturers, thus, making genuine commercial importers uncompetitive. It also causes the national exchequer to suffer heavy tax losses as more than 70 per cent of the domestic demand of polyester filament yarn is met through imports.

Approximately 2,000 tariff lines (representing 50 per cent of the SROs) are liable for import duties of less than 5.1 per cent, with almost 900 of them zero-rated. This is how tax laws have become a mockery of rule of law in Pakistan. The Chairman FBR himself admitted [The News, January 22, 2014] that "the government is facing a massive revenue shortfall as two third imports are duty free. It is a matter of grave concern for the FBR that the dutiable imports have dwindled in a major way during the current fiscal year."

The chairman, during a hearing before the Senate Standing Committee on Finance on May 13, 2014, revealed that "cost of tax exemptions granted over the years to the affluent was Rs480 billion per annum. He was asked to explain "why the FBR keeps on issuing SROs due to which customs duty, excise, sale tax and even income tax at source is not being collected and who are the beneficiaries". The chairman FBR said: "all of these exemptions cannot be withdrawn, as some are socially sensitive while others are protected under the constitution". He further revealed that "in the first seven months of the fiscal year 2013-14, Rs320 billion worth of exemptions were given that included income tax exemption given to independent power projects (IPPs) for electricity producers that is protected through agreements and will not be easy to withdraw."

The chairman was incorrect on both the points. First of all, no exemption can be granted through any statutory regulatory order (SRO) as held by the Supreme Court in Engineer Iqbal Zafar Jhagra and Senator Rukhsana Zuberi v Federation of Pakistan and Others (2013) 108 TAX 1 (S.C. Pak). As regards exemption granted to IPPs, it can also be withdrawn as held by the Lahore High Court in AES Pak Gen (Pvt) Company Lahore v Income Tax Tribunal Lahore (2006) 93 TAX 159 (H.C Lah.) and endorsed by the Supreme Court in Uch Power (Pvt) Ltd and others v Income Tax Appellate Tribunal and others 2010 SCMR 1236.

Through SROs, Executive nullifies the provisions of tax laws approved by Parliament, whereby 1973 Constitution provides in Article 77 that the sole prerogative to levy taxes is with the Legislature and this power cannot be delegated as enunciated by the apex court in Engineer Iqbal Zafar Jhagra and Senator Rukhsana Zuberi v Federation of Pakistan and Others (2013) 108 TAX 1 (S.C. Pak) that is binding on all institutions and persons under Article 189.

The ex-governor of State Bank of Pakistan, Shahid Kardar, aptly summarised: "It is indeed revealing that the cost of such tax waivers and exemptions is in excess of Rs350 billion a year, and then we lament that our tax-to-GDP ratio is amongst the lowest in the world. In the case of customs duties, as against the effectively traded 5,000 tariff lines there are SROs covering 84 per cent of them -- impacting 45 per cent of imports and encompassing almost all sub-sectors, rendering the actual tariff different from the standard tariff. This has resulted in the customs tariff having multiple rates, several exemptions and several conditions’ requirement fulfillment, providing opportunities for the discretionary use of powers by officials, raising the cost of doing business and incentivising malpractices, corruption and misdeclaration for evading duties.

Similarly, SROs issued under Sales Tax Act, 1990, Federal Excise Act, 2005 and Income Tax Ordinance, 2001 extending preferential treatment enable the beneficiaries to ‘extract rents’ and make easy money without having to make the effort to produce and market competitively a good quality product. "Many a rags-to-riches story can be traced to this ubiquitous instrument, which has made large chunks of the manufacturing sector addicted to high levels of protection".

It is reported in Press that the FBR, as a condition of IMF’s US$6.6 billion loan, conducted an exercise to simplify and revise three major concessionary customs notifications, namely, SRO 565(I)/2006, SRO567(I)/2006 and SRO575(I)/2006 in the budget of 2014-15 on the basis of laid down principles after consultation with the Engineering Development Board (EDB). These principles are:

Principle-1: Non-utilised or minimally utilised entries; (Deletion of entries in SRO indicating import value is less than Rs30 million annually).

Principle-2: Deletion of duplicate or redundant entries in SROs.

Principle-3: If 80 per cent import is under SRO, entry be shifted to tariff on SRO rate or to closest higher tariff slab.

Principle-4: If 20 per cent import is under SRO, entry be shifted to Pakistan Customs Tariff on tariff rate.

Principle-5: If import under SRO is between 20 per cent to zero per cent:

- if difference between SRO rate and tariff rate is (less than or equal to) 2 per cent, entry be shifted to tariff at normal tariff rate).

- if concession deemed essential, entry be shifted to tariff at closest higher rate.

- if concessions deemed critical, entry be shifted to Chapter 99 of the PCT at concessionary rate.

- all others to normal tariff rates.

The FBR also undertook an extensive exercise for simplification/revision of concessionary SROs [SRO 565(1)/2006, SRO 567(1)/2006 & SRO 575(l)/2006] with a view to analyse the impact of concessionary regime on industrial growth, export competitiveness, import substitution, further localisation of parts and more importantly passing on the benefit of concessions to the end consumers.

The critics of the FBR say that this process is essential but it should be through consultative process in the National Assembly and Senate and not behind the closed doors of the FBR. The right to taxation or give exemption is exclusive domain of the Parliament and Executive (FBR) should only implement the laws and refrain from legislation.