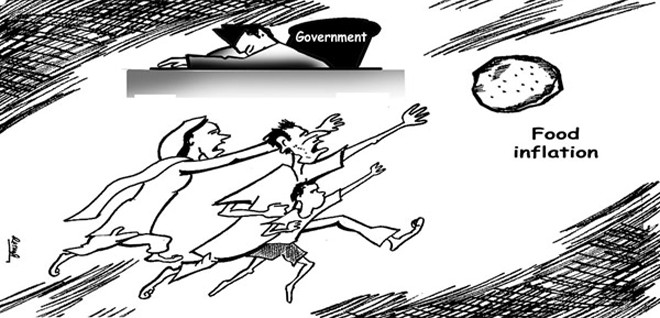

Profiteers and hoarders cash in on the government’s failure to check price-hike

Prices of every kind of goods usually sky rocket on every religious occasion in Pakistan whether it is the advent of the month of Ramazan, Eid or any other reverent occasion. People now take increase in prices as a routine, especially before Ramazan and unfortunately the government’s tall claims that prices will be kept within limits and availability of goods will be ensured in the market evaporate in the air every year.

Why the prices go up on certain occasions? There are variable market forces which determine prices of goods and services in a specific environment, but the government policy makers also play a very effective role in keeping equilibrium between demand and supply of goods and devise a mechanism to maintain prices at a certain level.

There are certain individuals in the business community who exploit the market forces to serve their vested interests by creating artificial price-hike while the government is sometime obliged to print excessive currency to bail out the monetary system from an imminent collapse. However, whether it is the monetary policy, price mechanism, or the administrative failure, it is the ultimate responsibility of the government to contain the market variables and establish its writ in every sector of the economy.

Inflation is a general and progressive increase in prices of goods and services in a country after the money loses its power to purchase anything over a period of time. This condition is commonly known as dearness in general public as the money loses its real value and scarcity of goods curtails the purchasing power of the people in a given situation. The inflation rate is generally measured in annual percentage change in a general price index. Inflation is often regarded as economic malaise which not only affects savings and investment but also pushes market forces for more shortage of consumer goods.

According to experts, the government also reaps the benefit of inflation even in this situation by adjusting real interest rates and attracting investment in certain projects.

When prices of essential goods take a forward leap, they also affect other sectors of the economy, creating a wide gap for hoarders, black marketeers and profiteers to gain from the government failure or more precisely the system or the administrative failure.

Causes of inflation in Pakistan: Economists blame the excess money supply for inflation in Pakistan, which also affects the real GDP growth. They suggest an effective monetary policy by the central bank to contain inflation within limits. However, some financial experts believe that disparity between demand and supply of goods and freakish increase in currency notes are not the only causes of inflation in Pakistan as many other factors are also involved in it.

"Apart from the administrative failure, Pakistan also faces political instability, natural disasters and security situation in the region, affecting the national economy," says Ahmed Ejaz, an economist who is a senior official in a commercial organisation.

He says that it is unfortunate that Pakistan faces shortage of food grains despite the fact that its economy heavily depends on agriculture sector. He adds that the prices of food grains also affect the prices of other commodities and causes inflation in the country.

Ejaz says that energy crisis and rising cost of raw material also hinder the achievement of required level of production which also affects the country’s exports, adding that the rate of production of goods came down to 2.5 per cent at a certain year, whereas the population continued to increase at the sharp rate of 3 per cent.

However, Saleem Mehar, another economist says that there is a need to develop industrial base to increase production of goods and generate money. He adds that cosmetic steps of the government will never produce positive results. He says that the government often opts for deficit financing which means less income but more expenditure and then it has to inject more money in the market to run the economy. He says that this step of the government starts a vicious trend of price hike as the demand for goods and services increases due excess of currency and its ultimate result is inflation.

Mehar says the country is facing acute energy crisis hitting the economy hard. He says that purchasing power of the common man is diminishing day by day, but the government is spending lavishly on non-development expenditures.

Price control committees: The provincial governments have set up price control committees and task forces to monitor and fix prices of essential items. The prices wing of the Industries, Commerce and Investment Department is responsible for controlling prices under "the Price Control and Prevention of Profiteering and Hoarding Act, 1977". The industries, commerce and investment secretary and the director of industries are entrusted with the job to act as controller general of prices.

The government monitors prices through price control committees which are also responsible for ensuring availability of goods at the government notified rates. But the dark side of the situation is that profiteers could not be effectively fixed, monopolisation of goods is still rampant, and hoarders continue to hoard essential items.

"The government deputes regional commissioners, police officers and district coordination officers to monitor markets under their jurisdictions," says Mehar, adding that an effective and permanent mechanism must be devised to implement the government policies to control prices of essential items.

He says that ad hoc measures such as establishing Ramazan bazars, Sunday bazaars, or Sasta bazaars will serve no purpose either as people want availability of goods at cheap prices without knowing the fiscal or economic intricacies.