The Khyber Pakhtunkhwa government presented its budget for 2014-15 with an outlay of Rs404.8 billion last week. The Rs139.8 billion annual development programme is 20 per cent higher than the current year. It also includes Rs39 billion foreign component of which 79 per cent are grants.

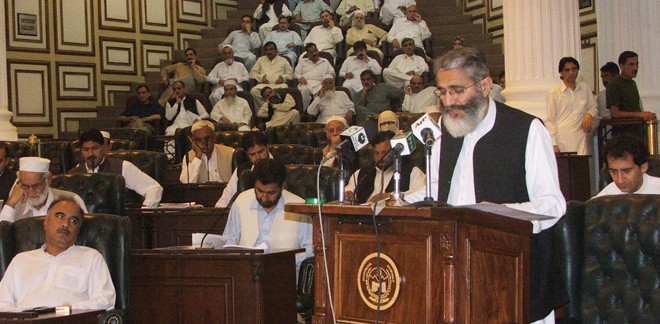

KP Finance Minister Sirajul Haq says the province has abundant human and natural resources but its population is living under poverty and backwardness due unfair distribution of resources and lack of good governance.

Major revenue receipts include Rs227.12 billion federal tax assignments, Rs12 billion net hydel profit plus Rs32.27 billion as NHP arrears, Rs29.26 billion oil/gas royalty, Rs27.29 billion war on terror grant, Rs35.35 billion as foreign assistance besides some others sources.

KP’s own revenue receipts estimated at Rs29 billion (up by 70 per cent against the current year) include Rs19.45 billion tax receipts and non-tax receipts of Rs9.3 billion. Rs12 billion as GST on services which rose by 100 per cent is inclusive of tax receipts. The province also earns Rs2.85 billion from own power plants. Current expenditure (welfare and administrative) will be Rs265 billion.

The government’s development priorities are right, people say, but they doubt it will be able to meet its defined goals. Our successive governments have failed to create jobs thus leaving Pakhtuns searching for even menial jobs in other provinces or abroad, they argue. Most of the development funds for the outgoing year largely remain unutilised, claims an industrialist.

The public-private partnership act has been approved. The private sector would be involved in the construction and maintenance of public sector development projects. New industrial zones will be established but there is no plan for the revival of the sick industrial clusters like Gadoon Industrial estate.

Various hydel and alternate energy projects are being launched -- Rs7 billion have been allocated to construct 350 small dams, while 400 megawatts of electricity will be produced through gas whose cheap energy will be given to industries.

Zahidullah Shinwari, the president of the KP Chamber of Commerce and Industry, terms the budget a status-quo budget devoid of any vision and reform agenda. "KP is beset with flight of capital, rising unemployment, terrorism and energy shortage. Joblessness is on the rise -- there is 14.8 per cent unemployment in Khyber Pakhtunkhwa against around 9.5 per cent at national level."

"Emergency steps were needed for economic growth, industrial revival, infrastructure development, energy supply, revival of sick industrial units and improvement in law and order, but there is no proper roadmap. The government has failed to give new mineral, industrial, hydel, oil/gas and tourism policies reflective of its change agenda," he said.

There is contradiction in the figures. The finance minister said the current ADP has 611 on going and 378 new projects of which 209 will be completed this fiscal. The remaining and ongoing project are therefore 780. But he said the next budget will have 1251 projects including 611 ongoing and 540 new projects.

In education sector, the government will upgrade schools, establish IT laboratories in high schools, provide furniture to 2300 schools, provide sports facilities in 2400 schools, provide scholarships to talented students and offer free education to special persons in all colleges of the province.

Agriculture is the mainstay of livelihood for over 70 per cent of KP people, acknowledges the minister, but for 46 projects, only Rs1.58 billion have been allocated. While the allocation has been marginally increased, it has in fact come down as percentage to the ADP -- while the current year’s allocation was 1.8 per cent of local ADP, the new apportionment is 1.5 per cent.

In Rs39 billion foreign component of ADP, education again was the major beneficiary with Rs11.7 billion, followed by Rs7.6 billion for roads for five projects but agriculture gets only Rs0.8 billion, energy Rs2.6 billion and industries Rs1.6 billion.

The poverty and inability of farmers to use enough quality inputs to raise their produce is the biggest hitch, the minister says, but he comes up with only loans on easy terms for them.

The PTI fans and even some ministers are taking pride in ‘a record increase’ in education spending to Rs111 billion but critics say most of the allocation (over Rs80 billion) comprises current budget which is but natural for being the biggest employees-wise department of the province.

The detailed expenditure report for the current year also reveals that vital social and economic sectors of the ADP like social welfare, education, agriculture, energy/power and industries had been allocated Rs0.6 billion, Rs24 billion, Rs1.53 billion, Rs2.2 billion and Rs4.4 billion respectively, but actual utilisation remained at Rs.2 billion, Rs3.72 billion, Rs0.63 billion, Rs0.65 billion and Rs1 billion in this fiscal.

In a bid to increase KP’s own revenue receipts, the government intends to raise the ratio of provincial taxes and fees on stamp duty, professionals and professional institutions, business establishments, agriculture income and salaries. The rise in taxes/fees is expected to hit the consumers ultimately for it will be passed on to them. Strangely, a PTI-led government is to tax educational institutions including medical, engineering and law colleges.

As per the Finance Bill 2014-15, an annual tax of Rs330 will be levied on a person in any profession and trade who earns between Rs10,000-Rs20,000. While a person earning between Rs200,000-Rs500,000 will pay tax of Rs10,000.

The employees of grade 1-5 have been exempted from the tax and the minimum professional tax threshold has been increased from Rs6000/pm to Rs10000 a month which, the finance minister said, will provide relief to low income class. But does the assertion hold any ground on the face of the fact that minimum monthly pay has been already fixed at Rs12000/pm.

Twelve categories are suggested for urban immovable property (UIP) tax. For technical education, Rs3.7 billion have been allocated and a technical university will be established. Rs2.7 billion have been earmarked to give interest-free loans of Rs50,000-200,000 to jobless youth on their personal guarantee.

The government proposed ‘several austerity measures’ to bring down expenditure. No foreign treatment/training, no new cars and no posts to be allowed unless approved by the chief minister.