The Federal Board of Revenue (FBR) has failed to achieve the real tax potential despite imposing all kinds of oppressive taxes. It is wrong to say that Pakistanis are not paying taxes. Yes, the powerful and the rich are not as they enjoy exemptions, concessions, immunities and amnesties.

Businessmen say they are ready to pay sales tax on all transactions, but the input-output based value added tax (VAT) is not viable in Pakistan’s peculiar milieu. They allege that it has only created a powerful mafia -- comprising unscrupulous traders, dishonest tax advisers and corrupt tax officials. Courtesy this mafia, the effective collection rate under sales tax is 3.7 per cent against the standard rate of 17 per cent.

Not only VAT has failed to take roots in Pakistan, its high rate and regressive nature is proving disastrous for millions living below the poverty line who are bearing its agonising burden. The burden of this tax, just like those imposed as full and final under the Income Tax Ordinance 2001, is being transferred on the consumers, making the rich richer. In the budget 2014-15, the government needs to shift to single-stage sales tax across the board at the rate of 5 per cent -- it will yield more revenue than what is presently collected and end corruption. At the same time, income tax from all those who have taxable income should be collected abolishing all kinds of presumptive and minimum tax regimes.

After doing away with all kinds of immunities, especially section 111(4) of the Income Tax Ordinance, 2001, the government should also enact asset-seizure legislation for confiscating untaxed assets. This strong deterrence is a prerequisite for enforcing tax obligation. Even a just and fair tax system cannot work if not supported by effective enforcement mechanism. All untaxed assets -- lying inside or outside Pakistan -- should be seized. This legislation will be true manifestation of people’s rule confirming an unshakeable determination, consistency and political will to curb the 67-year-old habit of defying tax laws, together with complete purge in the tax machinery.

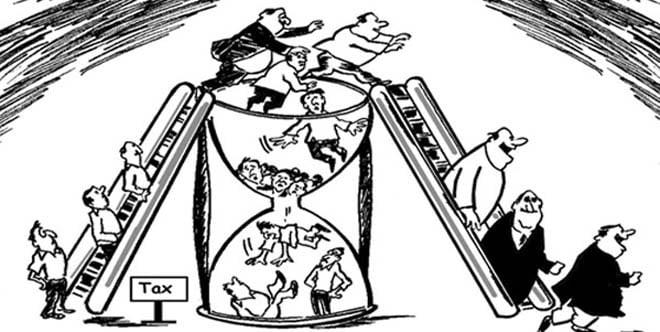

The primary function of any tax policy is to raise revenue for the government for its public expenditure. So the first goal of a development-oriented tax policy is to ensure that this function is discharged effectively but simultaneously it ensures removal of inequalities through redistribution of income and wealth. Higher rates of income taxes, capital transfer taxes and wealth taxes are some of the means for achieving economic justice. In Pakistan, an opposite approach has been adopted: there has been a complete shift from equitable to highly inequitable taxes. The progressive taxes aimed at removing inequalities have been consistently replaced with regressive ones favouring the rich and powerful.

The successive governments, civil and military alike, have miserably failed to discharge their basic obligation of protecting life and property of its people, what to talk of providing essential services -- health, education, housing and transportation -- free of cost. Taxes collected are consumed mainly by debt serving, defence, perks of VIPs, security of the rulers and their foreign tours. Besides indulging in regressive taxation, the government keeps on borrowing at a high cost, from whatever source available, to run day to day affairs. Interest payments on domestic and foreign debts during the ongoing fiscal year are likely to exceed Rs1500 billion (66 per cent of revenue target).

It is now well-established that there is a direct link between growing poverty in Pakistan and distortion in tax base since 1991, when a major shift was made by introducing presumptive taxes (indirect taxes in the garb of income tax) and VAT-type sales tax. Since 1991, the burden of taxes on the poor has increased by 38 per cent whereas on the rich it stands reduced by 18 per cent.

The lack of judicious balance between direct and indirect taxes has pushed an overwhelming majority of Pakistanis towards the poverty line -- their number is now more than 60 million. The FBR claimed in Year Book 2012-13 that the share of direct taxes rose to 38 per cent. It was a total misrepresentation. In direct tax collection, the share of presumptive taxes was not excluded. With such exclusion, the share of income tax comes to hardly 25 per cent or even less. It confirms that our taxation system is highly regressive. The IMF and other lenders are least pushed about the inequitable character of our tax system, under which the burden of taxes is less on the rich and more on the poor. They are merely interested in getting their money back with interest.

Over the period of time, our tax system has become rotten, oppressive, unjust and target-oriented. There is a dire need for discussing the philosophical framework, principles of equity and justice, which should be the main concern of our tax policy; not simply achieving of targets. Our fiscal managers want to meet budgetary targets through oppressive taxes, shifting incidence on the poorer segments of society and exempting the rich. We must enforce income tax and reduce progressive taxes. Undoubtedly, 17 per cent VAT-type sales has proved inflationary and its impact on business and industry has proved destructive.

The government may accept the demand of the Federation of Pakistan Chambers of Commerce & Industry for 5 per cent single stage sales tax subject to two conditions: first, there would be no refund and second, that all of them would pay income tax on their real income, but in no case less than 2.5 per cent on their net wealth at the closing date of tax year. This kind of alternate minimum tax is imposed on the rich in many countries, notably United States of America in recent years.

Presently, the perquisites and benefits of the government servants (civil-military) in kind are either not taxed or concessional rates apply. This creates unfairness in the tax system and dissuades ordinary people from paying taxes seeing the life of comfort and luxury enjoyed by them at their expense. This malady needs to be addressed to restore public confidence in the system.

Equity and justice demands that their perquisites should be monetised and composite salary on market rates should be given to all government servants in whichever grade they are serving. Ensuring decent living for them with strong accountability is necessary. At the moment, they complain that the state gives them inadequate emoluments to even survive. Not only should they be paid according to their needs and work but also made to pay tax in the same manner as other citizens belonging to the salaried class.

We can never tap our real tax potential, which is not less than Rs8 trillion, unless fundamental reforms in tax policy and administrations are made. Rapid industrial and economic growth and socio-economic justice should be our main objectives; tax being a by-product will automatically increase.